AI Agents will reduce wait times by 70% and create new roles | 10/30

Plus: The risk of vendor algorithms, fighting AI fraud with AI, and more!

Happy Halloween! Why did the ghost get declined for a loan? (Scroll for the answer.)

New here? Every week, I find the hottest AI news for Credit Unions to bring you practical insights in a quick, digestible newsletter.

Today, I cover:

Your next compliance risk is your AI vendor’s algorithm

AI Agents set to cut wait times by 70% and open new roles for Credit Union staff

AI fraud forces Credit Unions into an algorithmic arms race

Read time: 8 minutes

Top Stories

The biggest news this week…

1) Your next compliance risk is your AI vendor’s algorithm

Cornerstone Advisors’ Terence Roche warns that the biggest AI risks for Credit Unions may not come from tools they build, but from the vendors behind their lending, marketing, and fraud platforms. Many core providers are now embedding AI models or code generated by tools like Claude and Jasper, often with limited explainability or oversight. In fact, a Checkmarx survey found that CISOs reported 60% of their organization’s code was AI-generated in 2024, yet only 18% had approved AI tools.

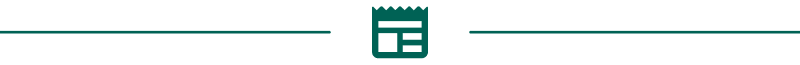

Four of the top six AI use cases that financial institution executives plan to deploy directly impact the member experience:

That overlap raises the stakes: how models are trained or tuned can quietly influence how members are served, scored, or marketed to.

Regulators and the U.S. Government Accountability Office are sounding the alarm with new “Know Your AI” guidance, urging financial institutions to evaluate every model for accountability, transparency, and fairness. This shift means vendor management is now an AI competency. Credit Unions must document all AI systems in use, strengthen contract language, and assign clear internal ownership for monitoring vendor algorithms.

As regulators push for explainable and auditable models, Credit Unions that move early on AI governance hygiene will stay compliant and protect member trust. (link)

2) AI Agents set to cut wait times by 70% and open new roles for Credit Union staff

Gartner predicts conversational AI will automate 70% of enterprise support interactions by 2027, and financial institutions are already feeling the shift. At Glia, an AI voice company, AI market lead Jake Tyler says Voice AI is approaching “human parity,” forcing banks and Credit Unions to rethink who works in their contact centers, how many people they need, and what those employees actually do.

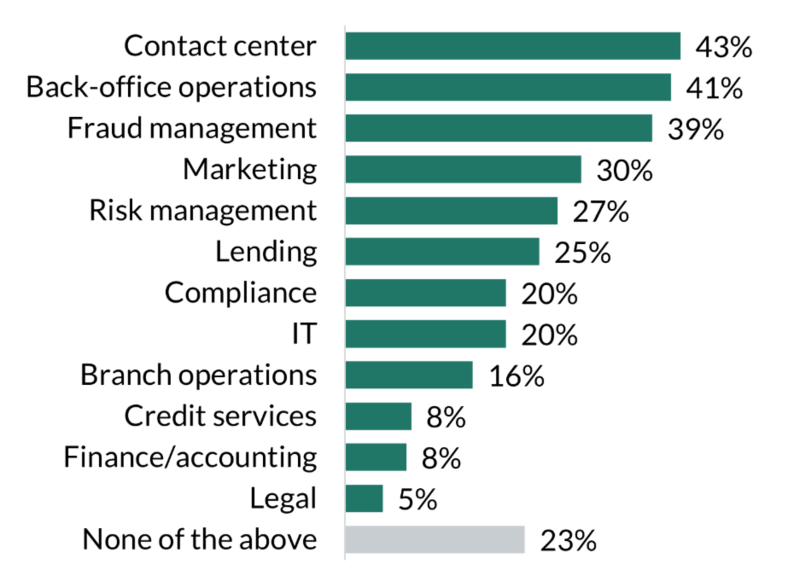

For some, automation means reinvestment instead of headcount reduction:

Service 1st Federal Credit Union’s virtual agent, “Scout”, has cut human-handled calls by 29%, reduced wait times by 71%, and slashed call abandonment from 25% to 1%, while reallocating staff for more meaningful work.

Granite Credit Union saved 1,400 hours in four months with similar tools, paving the way to retrain staff for fraud prevention and community outreach.

Experts say this transformation will separate those who simply save money from those who build stronger member experiences. For Credit Unions, Voice AI is less about cutting calls and more about amplifying human value. (link)

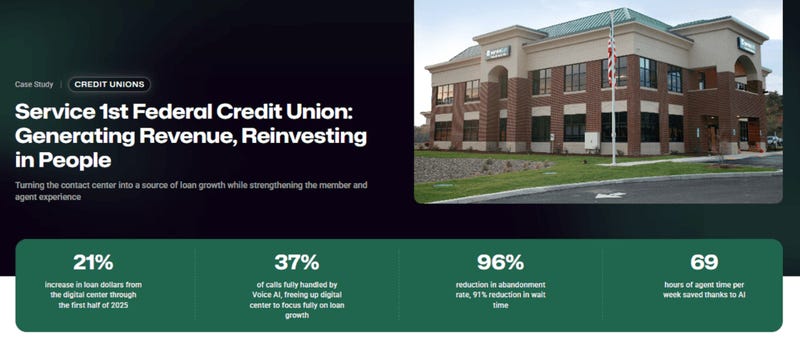

3) AI fraud forces Credit Unions into an algorithmic arms race

Nearly 8 in 10 Credit Unions suffered over $500K in fraud losses in 2023, and 33% saw scam cases soar by 50-100% in the past year. The culprit? Scammers are using generative AI to build synthetic identities complete with fake social histories, income records, and spotless credit scores. A single case at the University of Hawai’i FCU exposed how convincingly AI can mimic loyal borrowers before “busting out” with large loans.

Legacy identity checks and underwriting models are struggling to keep pace with AI systems that learn, adapt, and replicate human behavior. In response, 43% of Credit Unions are making fraud detection a top-three tech investment priority, and 88% are investing in identity risk solutions in 2025.

CommunityWide FCU reports catching sophisticated fraud that previously slipped through by using Scienaptic AI’s fraud detection, without adding friction for legitimate members. More Credit Unions are deploying adaptive AI that detects subtle deviations in application data and member behavior, trained from networks of institutions and 500M+ applications. (link)

Tips & Use Cases

Learn to apply AI…

McKinsey warns banks could lose $170B to AI agents: As consumers use AI assistants to automatically move money for better returns, banks could lose up to $170B in profits from idle deposits. Credit Unions can counter by deploying transparent, value-driven AI tools that help members optimize finances while keeping funds in-house. (link)

4 AI “dont’s” every Credit Union should follow: To protect member privacy and trust, don’t upload member data into public AI tools, don’t skip human reviews, don’t assume AI understands your policies or compliance rules, and don’t use AI as a strategist. (link)

How to mitigate AI as a Credit Union crisis risk: Reduce exposure by starting in the back office (knowledge retrieval, collections), keeping humans in the loop, banning personal info in prompts, and codifying internal AI policies. (link)

How Bill.com is using AI to give SMBs Fortune-500-level efficiency: Bill.com CEO René Lacerte says they’re building agentic AI task workers that automate payables, receivables, and approvals. Credit Unions can mirror this to speed up business lending, automate collections, and deliver CFO-level insights to members. (link)

Why Credit Unions should care how AI is reshaping insurance: AI is speeding up underwriting, claims, and fraud detection, creating $79B in new market value but also fresh challenges in trust and data use. Partner with AI-driven insurers to deliver faster claims, smarter coverage, and modern protection products members expect. (link)

New shared-services model helps smaller Credit Unions scale with AI and fractional expertise: The new Credit Union Shared Services (CUSS) initiative offers fractional management, back-office automation, AI-powered member experiences, and executive retirement programs to help small and midsize Credit Unions modernize without merging. (link)

How to design digital-first financial experiences that feel human: Gen Z and Gen Alpha are set to control $12T in spending by 2030. They’ll choose providers by prioritizing speed, design, and experience. Win them by pairing seamless mobile onboarding and AI-driven security with empathetic, human-centered design. (link)

JPMorgan turns to AI for employee reviews: The bank uses its in-house LLM Suite to draft performance reviews for its 300,000 employees, saving hours of manual writing while keeping humans accountable for final edits. (link)

How a lending marketplace’s CTO is using AI to balance growth, credit, and profit: Upstart’s models now train on 91M data points, are 171% more precise, and predict loan risk every month. Its 2025 roadmap aims to 10x AI performance and cover the full credit lifecycle, showing how smarter models can boost lending accuracy and ROI. (link)

AI won’t replace bankers, but rather expose the bad ones: Banks like Huntington and KeyBank are using AI for “continuous personalization,” analyzing customer behavior in real time to guide staff with next-best actions and sentiment insights. (link)

ChatGPT Atlas may change finance automation forever: OpenAI’s new Atlas browser introduces “Agent Mode,” letting AI navigate desktop interfaces to complete tasks visually, also known as “Glass-Box Automation.” Automate audits, reports, and finance workflows with full transparency and far less IT overhead. (link)

Dagster Labs uses Codex to scale education and documentation: Dagster Labs leverages OpenAI’s Codex to draft, translate, and validate technical documentation by testing whether the AI can generate functioning code from it. Credit Unions could adopt similar AI validation systems to automatically check policy compliance, streamline training materials, and stay audit-ready with less manual effort. (link)

How J.P. Morgan’s Head of Tech manages $10 trillion daily with AI workflows: Sri Shivananda oversees systems moving $10 trillion each day and says the future lies in “ambient payments” where transactions vanish into the experience. (link)

SoFi launches AI “Cash Coach” to win deposits from big banks: SoFi’s new AI tool helps users boost deposit interest and cut credit card costs, with plans to evolve into a full-service financial assistant. (link)

Funding Spotlight

Where the money is flowing for innovation…

Huntington Bank launches fintech venture studio to co-create AI and payments startups: The new partnership with Alloy Partners will incubate startups developing AI-powered financial tools and payment systems. It’s part of Huntington’s strategy to boost productivity, expand across the South, and modernize its technology infrastructure. (link)

Pave Bank raises $39M to build world’s first AI-driven programmable bank: The round, led by Accel, will fund development of a programmable banking platform that combines AI with digital asset infrastructure to automate treasury, payments, and FX operations. The model unifies fiat and digital assets under one compliance framework. (link)

Anrok raises a $55M Series C to automate global tax compliance with AI: Led by Spark Capital, the funding will scale Anrok’s AI platform that automates VAT, GST, and sales tax across more than 100 countries. The system cuts compliance workloads by up to 90% for clients, including Anthropic, Notion, and Cursor. (link)

Acoru raises €10M Series A to fight AI-powered bank fraud: Madrid-based Acoru secured funding led by 33N Ventures to expand its AI platform that detects and blocks scams before funds are transferred. Its consortium model enables banks to share account risk data, creating a collective defense against AI-driven fraud. (link)

Brico raises $13.5M Series A to automate financial licensing with AI: The funding, led by Flourish Ventures, will accelerate Brico’s expansion of its AI platform that streamlines complex state and federal licensing. The RegTech startup helps financial firms complete licensing five times faster, cutting costs and easing regulatory growth barriers. (link)

Defakto raises $30.75M Series B to secure AI and machine identities: The round, led by XYZ Venture Capital, will support the growth of Defakto’s Non-Human Identity and Access Management platform. The cybersecurity firm replaces static credentials with dynamic, verifiable identities for AI agents and services. (link)

Prospero + Finimize partner to deliver AI-driven insights to retail investors: Prospero.ai, whose AI trading signals have outperformed the market by 78% this year, is integrating its predictive analytics with Finimize’s research platform to bring predictive analytics and financial education to over 1M retail investors. (link)

Keeping up with Tech

The latest in fintech and tools…

Anthropic expands Claude for financial services with Excel and live market data: Anthropic added an Excel plug-in and real-time market data integrations from LSEG and Moody’s to Claude, letting users build and analyze models directly in spreadsheets. The update adds agent skills for valuations and due diligence, unifying data from Snowflake, Databricks, and external sources. (link)

Bottomline unveils embedded AI agent for treasury and cash management: The conversational AI agent, “Bea,” integrates into Bottomline’s Global Cash Management platform to provide real-time, predictive insights on liquidity and cash flow. (link)

Mastercard and PayPal partner on AI-driven payments: Mastercard’s Agent Pay will integrate into PayPal’s wallet, letting AI agents securely complete purchases using tokenized Mastercard credentials. (link)

Microsoft launches Azure Storage Mover for cloud-to-cloud data transfers: The newly released managed service enables encrypted, automated migration of data from AWS S3 to Azure Blob Storage. With incremental syncing and real-time observability, it streamlines multicloud data movement and improves AI data readiness for financial institutions. (link)

OpenAI launches ChatGPT Atlas, a browser with built-in AI: OpenAI introduced ChatGPT Atlas, a browser that embeds its AI assistant for real-time summarizing, browsing, and automation through agent mode. Credit Unions can use embedded AI browsing to streamline compliance checks, vendor research, and document reviews. (link)

ChatGPT launches “Company Knowledge” for workplaces: OpenAI rolled out Company Knowledge for ChatGPT Business, Enterprise, and Edu, connecting tools like Slack, Google Drive, and HubSpot to deliver cited, context-aware answers. It centralizes data securely to help teams brief, report, and decide faster while maintaining governance and compliance. (link)

Backbase makes AI the foundation of banking software: At Backbase Engage 2025, the company unveiled an AI-native banking platform built on MACH architecture and BIAN standards, embedding agentic AI into everything from design to integration. (link)

Google adds “vibe coding” to AI Studio for effortless app creation: Users can now build multimodal AI apps through natural language. Powered by Gemini, it auto-connects APIs and visuals, enabling anyone to prototype AI tools like assistants or dashboards without coding expertise. (link)

Worldpay launches AI-driven 3D Secure optimization service: Worldpay unveiled an AI-powered Authentication Optimization Service that boosts approval rates by 5.5% (in pilots) by deciding when to apply 3D Secure. Using insights from billions of transactions, it balances fraud prevention with faster, frictionless payments. (link)

In Other News

Related news you can learn from…

AI hype cools as failures spark ROI-prioritized pilots (link)

“AI-enabled” doesn’t necessarily mean it’s smarter — yet (link)

GTE Financial hires new VP to prioritize AI integration and emerging tech (link)

Anthropic to deploy one million Google Cloud TPUs in major AI expansion (link)

OpenAI strengthens ChatGPT’s mental health safeguards with 95% reliability in longer convos (link)

Community Corner

Memes and visuals…

Answer: No visible income

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!