AI News for Credit Unions | 10/16

Credit Unions outsmart AI fraud, Cutting call abandonment to 4%, AI enhances member experience, and more!

Welcome to the 1st edition of Credit Union AI Guy!

Every week, I find the hottest AI news for Credit Unions to bring you practical insights in a quick, digestible newsletter.

Today, I cover:

Credit Unions turn to agentic AI to outsmart AI fraud

Heritage FCU cuts call abandonment to 4% with AI

PenFed boosts digital use 80% as AI enhances member experience

Read time: 6 minutes

Top Stories

The biggest news this week…

1) Credit Unions turn to agentic AI to outsmart AI fraud

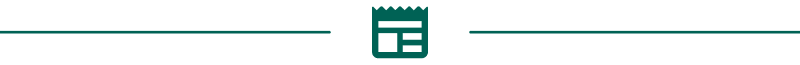

At a recent roundtable with i2c, Mastercard, and SRM, leaders warned that generative tools are being used to create deepfakes, impersonations, and synthetic identities at unprecedented speed. U.S. consumers lost $12.8 billion to fraud in 2024 — a 25% jump from the year before — putting pressure on Credit Unions to modernize their systems.

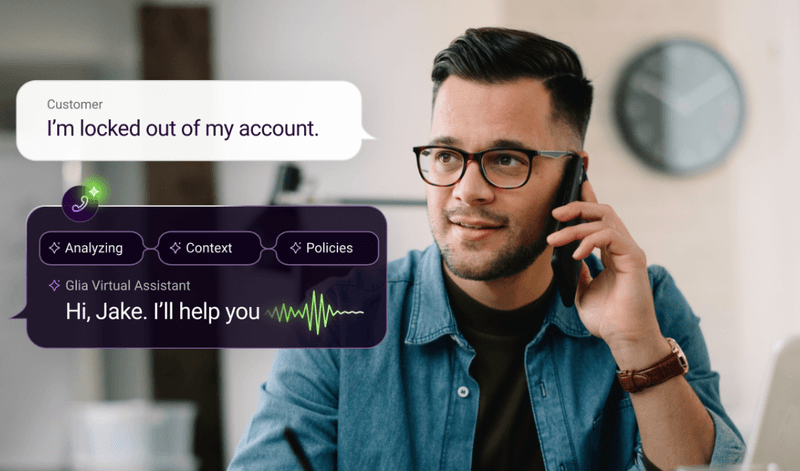

Visa’s Sam Hamilton says the next wave of protection will come from “agentic AI,” a smarter class of AI models that can learn and adjust on their own. These systems use real-time behavioral signals like typing speed, device data, and location to detect subtle shifts that older approaches often miss. Synthetic data is also giving teams a safe way to simulate fraud scenarios and train detection models without exposing member information.

For Credit Unions, this shift is as much about trust as technology. Agentic AI can continuously learn from new threats, tightening security without adding friction for members. This gives Credit Unions a crucial edge as fraud tactics evolve faster than ever. (link)

2) Heritage FCU cuts call abandonment to 4% with AI

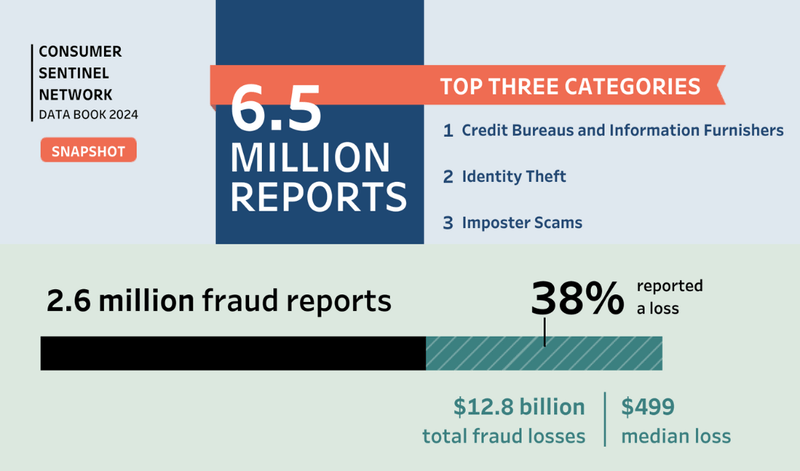

Heritage Federal Credit Union rebuilt its member support experience from the ground up, and the numbers show it’s paying off. The Credit Union overhauled its contact center in early 2024 using Glia’s digital engagement platform and a virtual assistant named Heidi. Members can now move seamlessly between self-service and human help without repeating themselves.

Since launch, call abandonment has plummeted from nearly 60% to 4.3% (last month), while Heidi now handles roughly a third of all interactions. AI assists nearly every agent call with real-time summaries and prompts, cutting post-call work to five seconds and allowing agents to manage multiple conversations at once. The result: 13% more calls answered without adding staff.

Rather than using those efficiency gains to downsize, Heritage redeployed capacity to higher-value tasks like opening accounts and funding loans. Goetzke’s advice to peers: design AI around people, not the other way around. (link)

3) PenFed boosts digital use 80% as AI enhances member experience

PenFed Credit Union’s Shree Reddy says the future of member experience will move beyond digital — becoming cognitive. Over the past two years, PenFed’s digital enrollments jumped 80%, and 97% of all interactions now happen online. The Credit Union is using AI behind the scenes for call summarization, sentiment analysis, and IT support, freeing employees to solve problems and build trust with members.

Reddy calls this “cognitive banking,” where AI anticipates member needs instead of reacting to them. Predictive tools can detect missed payments, suggest solutions, and alert staff before issues escalate, while internal AI systems help catch technical problems earlier and speed development cycles.

The lesson for Credit Unions: you don’t need a multimillion-dollar overhaul to start. Introduce AI in small steps, show members how it helps, and keep human empathy at the center of every interaction. (link)

Tips & Use Cases

Learn to apply AI…

How smaller Credit Unions can keep up with the big players: An Arizona Credit Union cut member escalations by 20% and reduced call times by 21 seconds after sandbox testing AI tools. Smaller institutions can compete by starting with focused pilots like virtual agents or voice biometrics before scaling. (link)

AI helps Allied Solutions cut coding time and uncover member issues: Using tools like Cursor and First Pass, Allied has increased developer productivity by 20% and automated data extraction from member emails and calls to fix recurring service issues. The company is now expanding AI use in fraud detection and credit risk monitoring. (link)

TD Securities launches AI assistant for traders: 1,000 employees are using the ChatGPT-powered tool to surface insights from internal research within minutes instead of hours. (link)

Members 1st names first AI Officer: SVP Robert Muth’s new AI leadership role focuses on using tech to enhance human connection. Members 1st is currently piloting AI chat and document automation to free staff to focus on member relationships. (link)

10 Steps for responsible AI adoption: Before rolling out new AI tools, make sure your teams understand how they work, your vendors can prove their data is secure, and your models are fully documented and explainable. (link)

AI chat moves marketing beyond the click: AI-powered chat and voice tools help Credit Unions shift from one-way ads to real-time conversations that build trust. By answering member questions instantly and personalizing recommendations, conversational AI drives stronger engagement, higher conversions, and more human-feeling campaigns. (link)

How to fight 3 AI identity fraud threats: Jumio’s VP of AI & Identity Analytics warns that deepfakes, document spoofing, and synthetic identities are reshaping fraud risks for Credit Unions. He urges adopting “adaptive trust” models that detect liveness, verify documents, and cross-check behavior patterns to stop fakes before they spread. (link)

How multi-agent AI transforms member experience: Credit Unions are shifting from single chatbots to orchestrated AI agents that jointly manage loans, fraud checks, and personalized support to deliver faster, more efficient, 24/7 member experiences. (link)

Fed says AI could increase fraud but make detection more affordable: Federal Reserve Governor Michael Barr said deepfake scams are rising as criminals use generative AI to impersonate clients and executives. On the bright side, falling costs could soon make AI-based fraud detection affordable for smaller banks and Credit Unions. (link)

How to redefine the CFO role in the AI era: Shift from clerical work to decision-making by adding specialized AI agents for close, FP&A, and treasury tasks. Use weekly decision memos to speed up planning and improve financial control, freeing teams to focus on strategy and outcomes. (link)

Fifth Third’s LLM-powered dashboards drive outsized branch performance: Smaller, more efficient Southeast branches are running at 160% of target, guided by machine learning dashboards that show bankers the 15 most valuable actions to take each day. (link)

Why Credit Unions should turn to private AI for safer marketing: Private AI models protect member data, enforce brand consistency, and provide more accurate analytics to automate marketing and communication securely. (link)

Funding Spotlight

Where the money is flowing for innovation…

Better Tomorrow Ventures closes $140M fintech fund: The early-stage VC firm raised a third fund of $140M to back 30-35 fintech startups using AI and automation to modernize accounting, compliance, and fraud detection across financial services. (link)

Salient raises Series A to automate loan servicing: Salient builds AI agents that manage borrower interactions across voice, text, and chat. Its platform has processed over $1 billion in transactions, helping lenders like Westlake Financial and Exeter Finance cut handle times by 60%. (link)

Rillet raises Series B to build AI-native ERP: Rillet is reinventing enterprise finance software with an AI-first ERP that automates accounting, reconciliation, and reporting in real time. The platform aims to replace decades-old systems like Netsuite with a self-driving financial operating system. (link)

Thomson Reuters acquires Additive to automate tax workflows: The startup, founded in 2023, uses generative AI to parse and process complex tax forms like Schedule K-1s, cutting hours of manual work for accounting teams. The deal expands Thomson Reuters’ AI tax automation suite. (link)

Gusto to acquire Guideline in retirement tech deal: Payroll and HR platform Gusto will acquire Guideline, a 401(k) provider with 65,000 customers and $20B in assets, to integrate payroll and retirement savings. The deal aims to make compliant, affordable plans more accessible to small businesses. (link)

Keeping up with Tech

The latest in fintech and tools…

Brex hits 99% accuracy on financial document processing: Brex standardized its document workflows with Extend to process invoices, receipts, and bank statements using AI-powered OCR, vision models, and fine-tuned LLMs. Extend cuts latency and manual work while improving data reliability across millions of documents. (link)

Google Cloud’s Gemini Enterprise brings agentic AI to banks: Commerzbank, Macquarie Bank, and Signal Iduna are adopting Google’s new Gemini Enterprise platform to create AI agents that automate research, document analysis, and customer engagement. The no-code system integrates with CRM and HR tools, helping financial teams streamline productivity across thousands of employees. (link)

Mastercard debuts AI-driven Payment Optimisation Platform: The new platform uses machine learning to analyze over a trillion data combinations and optimize transaction approvals in real time. Early pilots with Adyen, Tap Payments, and Worldpay saw approval rates rise by up to 15%, reducing friction and false declines. (link)

Visa builds the rails for AI agent payments: The new framework lets verified AI agents securely complete purchases on behalf of users, addressing fraud and trust issues as agentic commerce surges 4,700%. Partners like Adyen, Stripe, Microsoft, and Fiserv are testing the system to help merchants safely enable automated AI transactions. (link)

Stax becomes full processor to counter agentic AI threat: Stax launched Stax Processing to control the full payments lifecycle and reduce reliance on major processors like Stripe and Fiserv. Its AI agent “Benji” now resolves 70% of customer chats in 17 languages, as the company invests in agentic AI to automate payment routing and risk management. (link)

Brex founder outlines future of agentic commerce: Pedro Franceschi says AI agents will soon handle complex B2B purchasing, due diligence, and accounting workflows — turning traditional finance operations into autonomous systems. The shift highlights how financial institutions may soon rely on AI agents to handle approvals, reconciliations, and document reviews automatically. (link)

In Other News

Related news you can learn from…

Big banks dominate AI adoption, but smaller lenders can win with focus (link)

JPMorgan invests $2B in AI, claims equal savings from automation (link)

65% of finance professionals admit using unapproved AI tools at work (link)

AI-driven roll-ups to upend traditional debt collection (link)

AI platforms target $13T mortgage market to modernize lending (link)

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious credit‑union professionals. Come join the conversation!