AI texting cut this Credit Union's loan processing time to minutes | 10/23

Plus: The first bank to link data to Claude, 270% more conversions without incentives, and more!

Welcome to Credit Union AI Guy!

Every week, I find the hottest AI news for Credit Unions to bring you practical insights in a quick, digestible newsletter.

Today, I cover:

Guardian Credit Union cuts loan processing times from days to minutes with AI-powered texting

Grasshopper Bank becomes first to link banking data to Claude AI

Education Credit Union drives 270% more conversions without offering signup incentives

Read time: 8 minutes

Top Stories

The biggest news this week…

1) Guardian Credit Union cuts loan processing times from days to minutes with AI-powered texting

Guardian Credit Union has overhauled its lending process using Eltropy’s AI-powered text messaging platform integrated with Sync1 Systems. The $1.1B Alabama-based institution can now complete loan applications, document collection, and underwriting in a single phone call — replacing days of back-and-forth with real-time, secure communication. Staff send upload links that automatically route documents into the right loan files, streamlining workflows and eliminating manual errors.

Beyond lending, the platform is being adopted across departments for collections and member outreach. The results: faster turnaround, higher staff satisfaction, and improved member experience — all while supporting Guardian’s plan to open 10 new branches over five years.

The takeaway: AI-powered texting is becoming a channel for Credit Unions seeking speed and simplicity without sacrificing personal connection. (link)

2) Grasshopper Bank becomes first to link banking data to Claude AI

Grasshopper Bank has become the first U.S. financial institution to connect customer banking data directly to Anthropic’s Claude AI, using the new Model Context Protocol (a secure way to let AI systems access live business data without exposing it) for secure integration. The setup lets business clients query their accounts with natural-language prompts — producing instant insights without the need for spreadsheets or manual reports.

Early pilots show small businesses using Claude for real-time cash flow analysis and forecasting. The bank plans to expand beyond read-only access once safety and compliance testing is complete, paving the way for more interactive, data-driven AI banking experiences.

Grasshopper’s experiment signals the next phase of “digital banking,” where AI assistants evolve from back-office helpers to member-facing tools that deliver personalized financial intelligence on demand. (link)

3) Education Credit Union drives 270% more conversions without offering signup incentives

For Education Credit Union, even a simple marketing campaign once meant juggling data from multiple departments and waiting on vendors for segmentation. The fix? ECU’s marketing team turned to AI-driven marketing tools to break down data silos and sharpen its member targeting strategy.

Its “Smart Checking” campaign applied predictive models to 100,000 potential prospects, narrowing them to fewer than 10,000 high-propensity leads. Without offering any signup incentives, ECU achieved a 270% lift in conversions, adding $2 million in new loan balances and $250,000 in deposits. New members from the campaign adopted 8% more products on average, showing stronger engagement and loyalty. By integrating AI-based segmentation directly into its marketing workflows, ECU reduced vendor dependency, improved agility, and stretched its limited marketing budget further.

ECU’s success shows how using AI for precise, data-driven targeting can modernize outreach, amplify the human touch, and turn localized member knowledge into measurable growth. (link)

Tips & Use Cases

Learn to apply AI…

Get ready for “my AI made the charge” disputes: With 62% of members judging loyalty by how disputes are handled, Credit Unions must prepare for AI agentic commerce. To evolve, adopt proven, end-to-end AI dispute systems that integrate seamlessly with existing tech and deliver measurable value within 90 days. (link)

How AI could reverse the Gen Z exodus from Credit Unions: Only 14% of Gen Z use a Credit Union as their primary institution, and over a third plan to leave within a year due to outdated tech and limited personalization. Use AI for education, 24/7 support, and predictive guidance to rebuild loyalty and relevance with younger members. (link)

How to win stakeholder buy-in for AI projects: smartR AI CEO Oliver King-Smith says leaders should frame AI initiatives around measurable results like “cutting loan processing costs by 20%” instead of vague innovation goals. Launch AI pilots to demonstrate quick wins and adjust underperforming initiatives. (link)

How to predict member needs with AI: Alkami’s platform analyzes over 50,000 behavioral data tags to forecast member actions like opening a loan or CD, automating everything from model training to campaign activation. Data becomes foresight to meet member needs before they act, driving proactive growth. (link)

Temenos’ AI screening slashes false positives from 8% to 2% at Tier 1 bank: Temenos is embedding generative, agentic, and explainable AI directly into its core banking systems to simplify workflows and enhance decision-making. Another client cut business account opening times from weeks to minutes. (link)

Citi trains 175,000 employees on GenAI: Citi is mandating “Prompting Like a Pro” training to embed GenAI into daily workflows across 175,000 staff, aiming for up to 20% productivity gains. With less than 5% of bank and Credit Union staff trained on AI, many risk falling behind in efficiency, service, and talent retention. (link)

How small, medium, and large banks should approach AI differently: A study found 70% of financial institutions have no measurable AI results, but new orchestration tools are changing that. Small Credit Unions should use low-code AI to launch digital products fast, midsized ones should adopt AI to regain control from slow vendor systems, and large institutions should use AI sandboxes to scale innovation safely. (link)

Microsoft’s “Frontier Firm” model for banks could cut manual work by 99%: AI spending in financial services is projected to hit $97B by 2027 as institutions shift from pilots to full-scale agent deployment. The “Frontier Firm” framework shows how AI copilots + human oversight can automate back-office tasks, personalize member experiences, and help institutions compete on intelligence, not size. (link)

3 AI use cases from AWS that transform financial services: Genpact cut case-review time for financial crime investigations by 60% using Amazon Bedrock, Bridgewater built an AI analyst assistant with Claude to automate research, and NatWest boosted marketing click-through rates 4x with generative content. (link)

The 2026 growth strategy powered by data and AI: As fintech competition and economic pressures mount, Credit Unions must activate first-party behavioral data, build AI literacy, and unify every digital touchpoint around a member-first experience. Those that use AI to personalize and scale human connection will deepen loyalty and drive sustainable growth. (link)

Credit Karma uses AI to personalize experiences across generations: Credit Karma’s AI platform personalizes recommendations so Gen Z and Millennial members receive guidance suited to their financial stage. By focusing on shared needs instead of age-specific features, the adaptive experience improves usability for all members. (link)

What AI efficiency really looks like for big banks: Citi says AI-driven code reviews save 100,000 hours weekly, while Bank of America’s Erica assistant handled 2 million customer interactions in a single day. Yet JPMorgan’s CFO admits that quantifying AI’s true cost savings remains difficult. (link)

How to use AI to drive tangible results: We have three near-term AI applications for Credit Unions — personalized engagement, automated loan processing, and real-time fraud detection. Plan a roadmap that starts with team education and small pilot projects to prove measurable value, while relying on intelligent architecture and governance. (link)

UBS appoints first Chief AI Officer to scale AI across the bank: Former JPMorgan executive Daniele Magazzeni will lead UBS’s new AI office to expand use cases, strengthen governance, and enhance client and employee experiences. UBS already runs 300 active AI initiatives, including Microsoft 365 Copilot and its in-house assistant, Red. (link)

How to use AI as your next financial analyst (not your replacement): Use tools like Claude to build full 3-statement financial models, run scenario analyses, and update forecasts directly in Excel — all from a single prompt. AI enables faster insights, cleaner data, and fewer manual errors to focus on strategy instead of spreadsheet cleanup. (link)

Chase adds PIN step to fight AI deepfakes and Face ID fraud: JPMorgan Chase’s new “Extra Security at Sign-In” feature adds a device PIN alongside Face ID to prevent account takeovers from deepfakes and stolen phones. Early adoption has been strong, with 75% of new biometric users opting in. (link)

Funding Spotlight

Where the money is flowing for innovation…

PortX raises growth round, backed by Allied Solutions: PortX’s AI-powered data platform helps financial institutions connect fintechs and core systems faster. The partnership will automate payment workflows and enable real-time data access through PortX’s open, cloud-native architecture. (link)

Kitsap Credit Union invests in D8TAOPS to shape future agentic workflows: Washington’s first state-chartered Credit Union to make an AI equity investment, Kitsap partnered with D8TAOPS to co-develop agentic systems that cut loan audit times from 24 hours for 3% of loans to near real-time across the portfolio. (link)

Reducto raises $75M Series B to expand AI document intelligence: Led by a16z, the company’s vision-language platform now processes nearly a billion pages monthly to automate legal, lending, and financial workflows. (link)

Keycard raises $38M Series A to secure AI agent identity and access: Backed by a16z, Boldstart, and Acrew, the startup replaces static API keys with dynamic, task-based permissions for AI systems. Platforms like Keycard could be key to ensuring AI actions are verifiable, compliant, and secure. (link)

Campfire raises $65M Series B to scale AI-native ERP platform: Led by Accel and Ribbit Capital, the round brings total funding to $103.5M as demand for automation-first finance systems accelerates. The AI-driven ERP modernizes reporting, compliance, and financial decision-making. (link)

Finster AI raises $15M to expand AI-native financial intelligence: Led by FinTech Collective and Peak XV, the startup builds secure AI tools for investment banking and asset management. Its verifiable, domain-specific approach helps institutions safely adopt AI for forecasting, compliance, and smarter member insights. (link)

Resistant AI raises $25M Series B to advance fraud detection tech: Led by DTCP with backing from Experian, Notion Capital, and GV, Resistant builds specialized machine learning models to detect document and transaction fraud. (link)

Cube acquires Kodex AI to build agentic compliance platform: UK regtech Cube bought Germany-based Kodex AI to add agentic “AI co-workers” that automate compliance analysis and regulatory updates up to 95% faster. The deal advances Cube’s vision for a unified compliance, risk, and AI platform. (link)

Clove raises $14M pre-seed round to scale AI-powered financial advice platform: Led by Accel, the London-based fintech combines human advisers with automation to make financial guidance more affordable and accessible. Its AI can handle administrative tasks, freeing staff to focus on personalized, human-centered member advice. (link)

Keeping up with Tech

The latest in fintech and tools…

BNY Mellon rolls out enterprise AI platform Eliza: The platform unifies data and streamlines operations across departments as part of the bank’s broader platform operating model. BNY Mellon is also offering free AI and cybersecurity training to 1,000 community bank executives to strengthen digital literacy across the financial sector. (link)

Anthropic launches Agent Skills for task-specific Claude customization: Agent Skills lets organizations package instructions, scripts, and resources so Claude can handle specialized tasks — like working in Excel or applying brand guidelines — with greater accuracy. Skills are modular, shareable, and secure, enabling enterprise-grade customization. (link)

Claude integrates with Microsoft 365 and adds enterprise search: The new integration lets Claude securely analyze data across SharePoint, OneDrive, Outlook, and Teams to summarize projects and synthesize discussions without manual uploads. Enterprise search gives users instant access to company-wide insights. (link)

FIS expands agentic AI into payments with Smart Basket: The new platform analyzes payment and loyalty data to automatically apply the most cost-effective payment methods at checkout with minimal human input. (link)

Tavant debuts TOUCHLESS AI Suite to automate mortgage origination: Powered by agentic AI, the suite automates the entire mortgage process — from lead to funded loan — and includes MAYA, an AI assistant that guides borrowers and answers questions in real time. (link)

Walmart introduces ChatGPT-powered Instant Checkout: Walmart and Sam’s Club members can now shop directly through ChatGPT using the new Instant Checkout feature. Users can plan meals, restock essentials, and buy products conversationally. (link)

In Other News

Related news you can learn from…

How AI helps finance professionals learn 10x faster (link)

Bank of England names AI as top priority for responsible financial innovation. (link)

Fed’s Waller calls on policymakers to “let AI disruption occur” for productivity growth. (link)

64% of insurers use AI for claims automation, despite 26% lacking formal governance. (link)

First City CMO says AI isn’t a standalone project, cites study where 95% of firms saw no AI ROI (link)

AI to reshape — not replace – finance roles, with advisors (+17.1%), and analysts (+9.5%) to grow through 2033 (link)

Trust will determine agentic AI’s success in financial services (link)

Community Corner

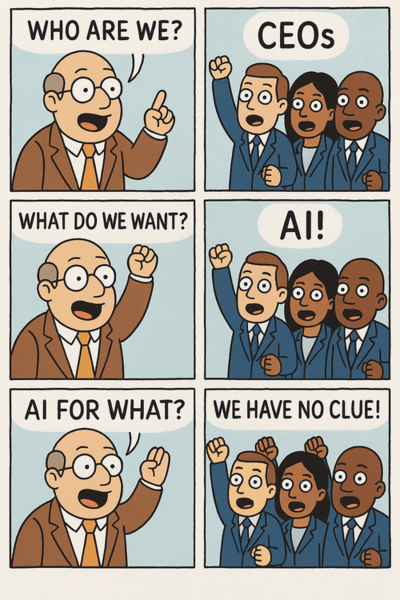

Memes and visuals…

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!