AI unlocks the underserved SMB market for Credit Unions | 11/13

Plus: Agentic AI is the new operating system for community finance, how BNY’s AI keeps them agile, and more!

Fun fact: The average Fortune 500 company now runs over 300 AI pilots, yet fewer than 5% ever reach full deployment. Not because of bad tech, but because their business never evolved to use it!

If you’re new here, I find the hottest AI news for Credit Unions to bring you practical insights in a quick, digestible weekly newsletter.

Today, I cover:

How AI is unlocking the underserved SMB market for Credit Unions

Agentic AI is the new operating system for community finance

BNY Mellon is proving that even a 241-year-old institution can move fast

Read time: 8 minutes

Top Stories

The biggest news this week…

1) How AI is unlocking the underserved SMB market for Credit Unions

On the CU 2.0 Podcast, Robert McGarvey sat down with JUDI.AI CEO Gord Baizley to tackle a problem every Credit Union leader knows too well: small business members want working capital, and Credit Unions want to help… but the economics have never made sense. A $50k café loan or a $75k landscaping loan takes almost as much staff time as a $1M commercial file. Touch the application twice, Gord says, and “you’ve already lost money.” Meanwhile, Fintech lenders filled the gap with fast cash-flow decisions — and 30-40% APRs — while big banks pushed entrepreneurs into personal loans or out of the relationship entirely. No wonder 40-50% of small businesses now cite access to capital as their biggest barrier.

JUDI.AI was born inside a Fintech lender that discovered a simple truth: FICO scores and Dun & Bradstreet profiles tell the story of yesterday, not whether a business can make its next payment. What matters is real-time cash flow. Today, roughly 45 CUs — from $25M institutions working through CUSOs to $30B giants like Vancity — use JUDI.AI to pull 6-12 months of transaction data through aggregators, turn raw statements into a synthetic cash-flow model, and run them through a behavioral AI model. The system consistently predicts a ~2% default rate on loans up to $250,000, with actual performance coming in even better. And when Libro Credit Union pre-qualified existing business members using their own account data, 30% of those offers converted into funded loans.

For Credit Unions, this is a strategic unlock. Roughly 25% of U.S. households have a small business attached to them. So, if you fund a member’s business dream, Gord says, “they’re sticking with you, and they’re bringing everything else with them.” With implementations that go live in 8-12 weeks, CUSOs providing underwriting capacity below ~$500M in assets, and subscription-plus-per-application economics that easily pencil out, small-business lending stops being the segment CUs “wish they could do” and becomes one of the most profitable lines they own.

More importantly, it’s how Credit Unions prevent their most entrepreneurial members from drifting to Wells Fargo or the next high-APR Fintech. (link)

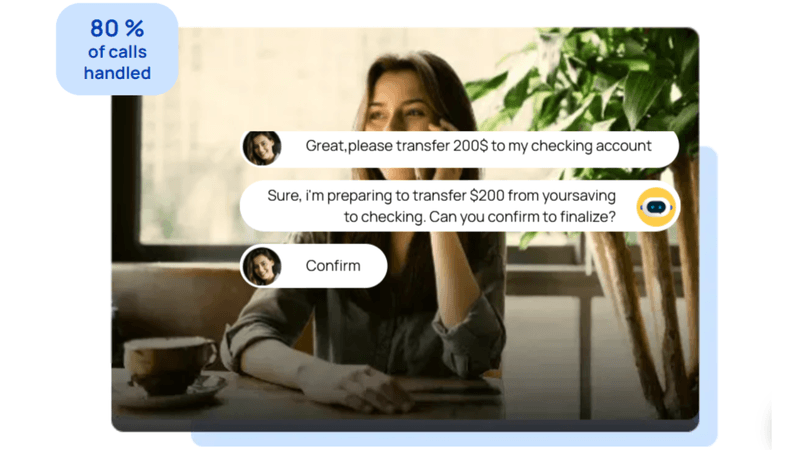

2) Agentic AI is the new operating system for community finance

How do you scale great service without turning into a call center with scripts?

A new wave of “agentic AI” is transforming how community banks and Credit Unions serve members, moving far beyond static chatbots into systems that can reason, act, and execute tasks across every channel. Platforms like BankGPT are leading the way, helping 100 banks and Credit Unions automate 40-60% of member calls, raise employee productivity by 40%, and lift revenue per member by nearly 30%.

Unlike first-generation chatbots, agentic AI can authenticate users, access account data, complete transactions, and hand off seamlessly to humans, all while maintaining full governance and auditability.

Looking to adopt a new AI platform? Evaluate them by using the AGENTS framework that focuses on auditability, governance, end-to-end action, omnichannel context, trust, and measurable outcomes. This ensures AI stays compliant and explainable.

One early adopter, a CGO at a large CU, says the payoff is tangible: “Wait times are down, containment is up, and every response is grounded in approved knowledge we can audit.”

Agentic AI is evolving into the “operating system” of member service, combining compliance-level rigor with human-like empathy, so the sooner you start integrating it in your workflow, the sooner you start seeing meaningful results. (link)

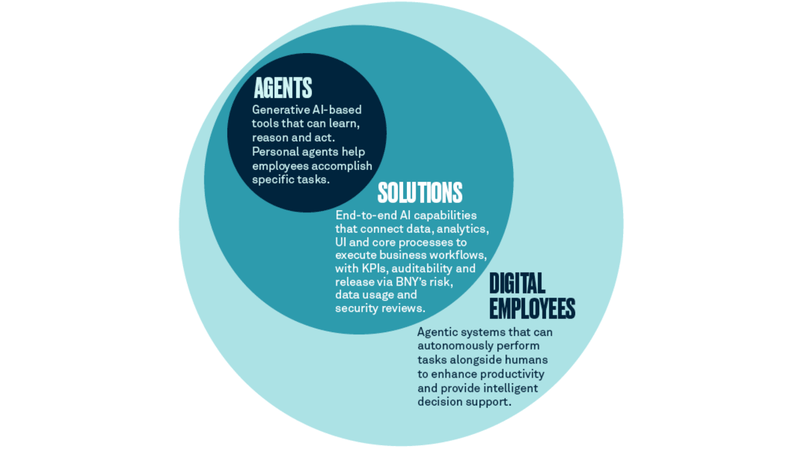

3) BNY Mellon is proving that even a 241-year-old institution can move fast

CEO Robin Vince points to Kodak as the cautionary tale: discover the future, fear it, then get left behind. At a 241-year-old bank, the dangers are piled high — multimillions of lines of aging code to secure, clunky payment rails to maintain, and a digital asset ecosystem that could easily run around traditional players if they hesitate too long.

Instead of freezing, BNY now runs over 100 AI “digital employees” through its enterprise AI system, Eliza 2.0, and has trained 99% of its workforce to build and use agentic tools. Designed as a horizontal, multi-agent infrastructure, the system lets AI agents collaborate across departments while remaining fully governed, audited, and secure. 20,000 employees have already built their own task-specific agents.

Vince describes innovation as both “a risk and a necessity,” emphasizing that failing to innovate poses the greater threat. BNY’s AI adoption goal is to augment employees and scale without adding headcount. (link)

Tips & Use Cases

Learn to apply AI…

AI fraud is evolving faster than banks can fight back: Harvard’s Shlomit Wagman says tools like FraudGPT are fueling a “collapse of digital trust,” as criminals clone voices and identities at scale, urging banks to adopt AI-native defenses, rebuild digital identity systems, and coordinate global countermeasures. (link)

Credit Unions get human-centered AI automation through CUNA Strategic Services + HuLoop alliance: The partnership gives CUs access to HuLoop’s human-in-the-loop tools for routing, document processing, and workflow orchestration, helping teams reduce manual work while preserving personalized member service. (link)

Cotribute + Corelation launch AI growth agents as 46% of CUs expect big AI shift: Cotribute’s acquisition and cross-sell agents are now available to 240 Corelation CU clients via the Keystone API, with Credit Union 1 and Nutmeg State Financial set to pilot the tools. (link)

How AI has become the true competitive edge for Fintechs: With markets saturated, Fintechs using AI platforms like Uptiq for underwriting, fraud detection, personalization, and automation are pulling ahead by cutting costs, reducing risk, and driving loyalty. (link)

AI to unlock $370B in banking profits by 2030 as big banks report ROI: Bank of America’s self-service AI has handled 3 billion customer interactions to date. Plus, AI models have cut fraud losses by 55% and made 18,000 developers 20% more productive. (link)

Generative AI turns Fintech into real-time financial copilots: Uptiq’s platform combines LLMs with financial expertise to build adaptive portfolios, automate compliance workflows, and surface 24/7 client insights. The system helps banks and advisors shift from routine processing to scalable, personalized financial guidance. (link)

New ChatGPT Apps SDK lets finance teams run entire workflows with one command: Wouter Born built a set of finance apps in ChatGPT to show finance teams how to ditch spreadsheets for conversational workflows to automate forecasting, reconciliation, reporting, and more. (link)

How automation helps Credit Unions stay CFPB-compliant as costs keep rising: With servicing costs rising and oversight in flux, automation helps cut errors, ensure audit-ready accuracy, and free up staff for higher-value member work. (link)

VentureTech 2025 proves AI is reshaping Credit Union innovation: Nearly every Fintech pitching at the conference showcased AI for workflow automation, predictive analytics, or generative models, signaling how rapidly AI is shaping vendor roadmaps and evaluation criteria for CUs. (link)

Embracing AI for smarter member service starts with trust and small wins: CSI’s Jeffery Nelson says Credit Unions should adopt AI gradually, prioritizing internal efficiency, guided by transparency and human oversight to enhance member trust. (link)

Mastercard’s AI doubles fraud detection speed as holiday scams surge: New data shows nearly half of shoppers would ignore warnings about discount scams, while Mastercard’s gen AI now spots compromised cards twice as fast and monitors 32M daily risk events. (link)

How to adapt to AI-accelerated deposit movement and refinance cycles: Agentic financial tools now monitor yields, rates, and account conditions in real time, automatically recommending or initiating transfers and refis. “Sticky” deposits and slow refinance behavior will erode, making speed, AI integration, and proactive pricing essential to retain members. (link)

AI video tellers bring human-like service to the digital branch: Kuwait Finance House and NCR Atleos’ new AI video avatar “Fahad” blends conversational AI, sentiment analysis, and live-agent support. (link)

Arta expands AI wealth platform with leading Asian banks: Bank of Singapore, Hong Leong Bank, and Ethivo Asset Management are deploying Arta’s generative AI platform to automate analytics, personalize portfolios, and scale advisory services across global wealth markets. (link)

Moody’s turns GenAI into a company-wide productivity engine: Moody’s scaled its Research Assistant faster than any tool in its history by embedding AI across research, sales, and strategy while enforcing strict data and risk guardrails. (link)

AI answers dominate financial searches with affiliates now controlling visibility: New data from Fintel Connect shows LLM searches up 150% year-over-year, with 60% of AI answers citing affiliate sites like NerdWallet. Financial brands must master “Generative Engine Optimization” or risk vanishing from AI-powered discovery. (link)

How banks can turn data chaos into a growth advantage: With nearly half of financial institutions still struggling with siloed, low-quality data, leaders say unified governance and smart AI integration can transform unstructured information into real-time insights and stronger customer relationships. (link)

Agentic AI set to shake up chargebacks before stabilizing payments: Global chargebacks are projected to jump 24% by 2028 as consumers and AI agents adjust, costing banks billions before new frameworks restore trust and reduce fraud long-term. (link)

PensionBee slashes compliance review time 88% with Adclear’s AI marketing auditor: The partnership brings Adclear’s AI-powered FinProm platform into PensionBee’s UK and U.S. operations, where it has reviewed more than 1,000 content pieces and automated key marketing compliance checks. (link)

Funding Spotlight

Where the money is flowing for innovation…

Zest AI raises customer-led round backed by major Credit Unions: The oversubscribed financing round, led by SchoolsFirst, Members 1st, ORNL, Truliant, and Citi, boosts Zest’s valuation beyond its $200M 2024 round. Its AI underwriting models 2x instant approvals and expand equitable credit access. (link)

Portal26 raises $9M Series A to help enterprises secure GenAI adoption: The round, led by Shasta Ventures, will scale Portal26’s AI governance platform, which detects Shadow AI, enforces policy, and provides visibility and ROI tracking. (link)

Fintary raises $10M Series A to automate insurance commission management with AI: Led by Infinity Ventures, the funding will expand Fintary’s platform that automates commission processing and reconciliation for insurers. The system cuts manual work from weeks to minutes while improving payout accuracy and agent satisfaction. (link)

AI Fintech Optasia goes public in $372M Johannesburg IPO: The UAE-based lender raised at a $1.3B valuation in one of South Africa’s largest Fintech listings. FirstRand Bank acquired a 20% post-IPO stake as Optasia expands AI-driven credit access across emerging markets. (link)

Truffle Security raises $25M Series B to expand AI-powered secrets protection: The round led by Intel Capital and a16z will scale TruffleHog Enterprise and new tools like GCP Analyze. The expansion strengthens protection against leaked credentials and non-human identities as AI-driven software development increases enterprise security risks. (link)

Daylight raises $33M Series A to lead new era of agentic AI-driven cybersecurity: Craft Ventures led the round to fund the creation of a new category of Managed Agentic Security Services and expand Daylight’s AI-native protection platform. The system uses autonomous agents to detect and respond to cyber threats in real time. (link)

Keeping up with Tech

The latest in fintech and tools…

Lloyds Banking Group pilots AI financial assistant with Google’s Vertex AI Platform: Already tested with 7,000 employees, the agentic tool offers 24/7 financial coaching, spending insights, and savings guidance. It retains conversational context to deliver personalized advice across mortgages, investments, and protection products. (link)

Ant International open-sourced the Falcon Time Series Transformer FX forecasting model: The 2.5B-parameter Mixture-of-Experts transformer delivers over 90% accuracy and cuts FX costs by up to 60%. Now open-sourced on GitHub and Hugging Face, it gives institutions a powerful tool to enhance cashflow forecasting and risk management. (link)

DBS launches “Joy,” a Gen AI assistant for corporate clients: The virtual agent has handled more than 120,000 chats and increased satisfaction by 23%, providing 24/7 personalized support. It escalates complex cases to human agents assisted by AI co-pilots for faster resolution. (link)

Clearwater Analytics launches CWAN GenAI for institutional asset management: The AWS-powered platform has cut manual work by 90%, reduced close cycles by half, and now supports 800+ client-built AI agents automating reconciliation, reporting, and risk management across $10T in assets. (link)

TRG Screen launches Xmon AI Assist for market data cost analysis: The conversational analytics tool combines LLM reasoning with a secure retrieval system that pulls data from a firm’s own documents, letting teams ask plain-language questions to identify cost drivers and uncover savings. (link)

Napier AI joins FCA-Nvidia sandbox to test anti-money laundering models: The regtech firm will trial new algorithms on large synthetic datasets using Nvidia’s computing platform to improve the speed and accuracy of money-laundering detection. The sandbox aims to help financial institutions develop safer, regulator-approved AI approaches for compliance. (link)

OpenAI unveils 2028 roadmap for safe, discovery-driven AI progress: OpenAI projects that AI systems could reach “discovery-level” capability by 2028 as model efficiency improves 40x per year, and is calling for global safety standards, oversight frameworks, and resilient systems to manage emerging risks. (link)

In Other News

Related news you can learn from…

UK Treasury commissions AI impact report for financial services (link)

95% of AI projects fail due to a lack of business reinvention (link)

Deloitte survey shows worker trust in agentic AI drops 89% (link)

94% of CEOs say AI could outperform human board members (link)

AI data centers could cause $20B in annual U.S. health damages (link)

Fed’s Barr warns AI may disrupt jobs before boosting long-term growth (link)

AI pushes companies to replace industrial-era diversification with data-connected portfolios (link)

Community Corner

Memes and visuals…

Thanks for reading!

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!