AI video verification stops $80k fraud attempt | 12/11

Plus: How CU West cut reporting time by 94%, AI lenders vs humans, and more!

Welcome back! This week’s edition is packed with real-world AI wins from Credit Unions.

If you’re new here, I find the hottest AI news for Credit Unions to bring you practical insights in a quick, digestible weekly newsletter.

Today, I cover:

AI video verification stops $80k fraud attempt at APL Federal Credit Union

How Credit Union West cut time spent developing reports by 94%

AI lenders outperform humans across 2 million decisions

Read time: 9 minutes

Top Stories

The biggest news this week…

1) AI video verification stops $80k fraud attempt at APL Federal Credit Union

APL Federal Credit Union averted an $80,000 wire fraud attempt after a payment support specialist noticed a subtle mismatch between a member’s profile and the caller requesting the transfer. The documentation looked legitimate, but the funds were headed to an individual instead of a title company. It became a clearer red flag when the caller showed unusual urgency and tried to dodge identity checks.

The saving grace: APL’s policy required video verification, powered by Eltropy Video Banking, for large third-party wires, giving staff the authority to pause the transaction without debate. When the impostor refused to appear on video, the wire was frozen, and three days later, the real member confirmed he had already lost $1.2 million at another institution that lacked similar controls.

For APL FCU, Eltropy Video Banking helps turn instinct into action. Staff can compare IDs live on camera, validate physical characteristics, and close the door on fraud within minutes. The tool has since become critical for high-risk wires and flagged Zelle transactions, remote account openings, and member authentication for out-of-state users. The result: fewer losses, faster workflows, and stronger member trust — reinforced by a Google review rating that jumped two full points. (link)

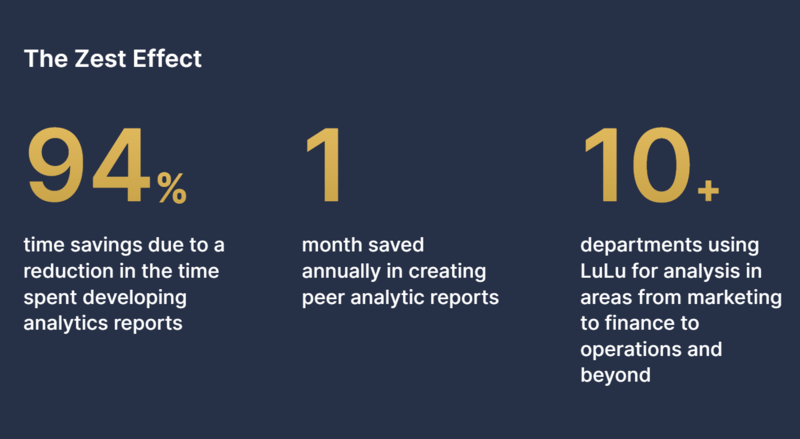

2) How Credit Union West cut time spent developing reports by 94%

Financial analysts at Credit Union West were drowning in manual reporting work, spending countless hours stitching together data from multiple systems to build peer comparisons and performance reports. The process was time-intensive, repetitive, and slowed down how quickly teams could generate insights for the CU.

With Zest AI’s LuLu analytics platform, tasks that once took three hours now take about ten minutes, cutting reporting time by 94% and saving nearly a full month of labor annually. Analysts now request the data points they want and receive structured, ready-to-use datasets. Beyond peer analytics, 10 other departments use the platform for product engagement, marketing outreach, and identifying operational inefficiencies. In the future, financial analyst Kinnidy Abitz sees future LuLu use cases for product insights, transactional trends, and deposit rate comparisons. (link)

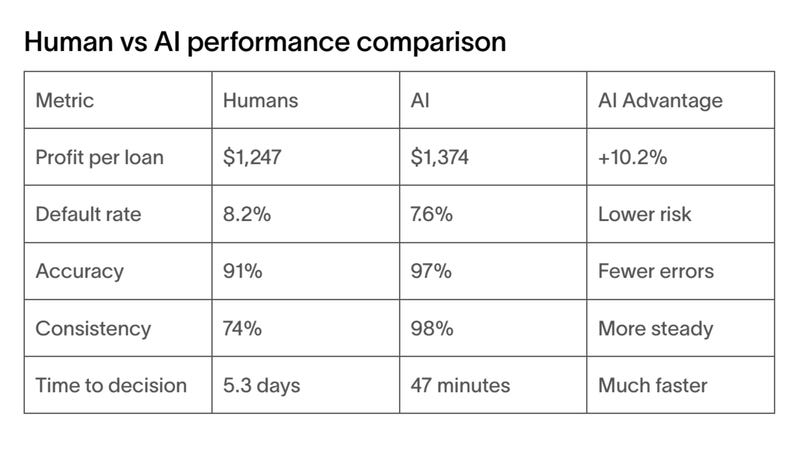

3) AI lenders outperform humans across 2 million decisions

For years, studies have shown that underwriters spend 40% of their time on manual tasks that don’t meaningfully inform decisions about who should receive a loan. Think: retyping PDFs, verifying numbers by hand, and chasing missing signatures…

But a new analysis of two million loans from Ohio State University researchers shows AI decisively outperforms human underwriters in risk accuracy, speed, and profitability. AI-generated decisions produced 10% higher profit per loan, lower default rates (7.6% vs. 8.2%), and 97% accuracy — while reducing decision time from 5.3 days to just 47 minutes. Performance gaps grew with more complex, higher-risk loans where AI’s success rate was more than 20 points higher. The study attributes the difference to human incentive pressures, decision variance, and cognitive overload, compared to AI’s ability to evaluate more than 1,000 variables consistently at scale.

Instead of replacing your team, AI enables an 80/20 lending model in which automation handles pattern recognition and high-volume cases, while your staff focuses on context-rich decisions and member conversations. By eliminating manual data entry and revealing creditworthy applicants that traditional scoring misses (like gig workers or thin-file members with strong payment histories), you extend fairer access while strengthening risk outcomes. (link)

Tips & Use Cases

Learn to apply AI…

How StagePoint FCU grew lending volume 51% without an increase in delinquencies: Zest AI’s underwriting solution increased decision automation by 23%, providing instant approvals that filled staffing gaps and let the Credit Union capture auto dealer applications after hours. LuLu’s GenAI tools also supported M&A evaluation and strategic planning with real-time benchmarking. (link)

Credit Union leaders explain why AI voice success depends on people: Leaders from CUTX, Cobalt CU, and P1FCU say adoption rises when teams help shape the bot, success criteria are defined upfront, and trust issues from past implementations are addressed directly. (link)

Chartway Credit Union cuts dispute costs 86% with AI automation: Casap’s platform reduced Chartway’s dispute workload from three staff members to one, shortened the five-day dispute process to same-day resolution, and dropped write-offs by 72%. Members now receive instant provisional credits, while staff feel more energized thanks to the streamlined workflow. (link)

Kitsap Credit Union uses agentic AI to audit 100% of loans in real time: Kitsap replaced a 24-hour manual audit that sampled only 3% of loans with agentic AI that reviews 100% of applications in near real time. The system provides instant compliance checks and next-best-offer insights while elevating staff into higher-skill oversight roles. (link)

How Horizon Credit Union uses AI to elevate human-led member service: AI turns complex financial data into conversational insights for staff and members, freeing staff for tasks that require emotional connection or decision authority. Offloading routine tasks gives teams more time for coaching and trust-heavy lending conversations. (link)

How Credit Unions can leapfrog fintechs with agentic AI experiences: Agentic AI turns chat into the primary banking interface, allowing members to check balances, move money, or apply for loans through natural language instead of apps or branches. CUs can “disrupt their disruptors” by launching AI-first spin-off brands that deliver agent-only experiences inside platforms like ChatGPT. (link)

AI governance becomes a first line of defense in fintech: As AI tools shape real-time decisions, frontline teams must understand how models work, how data flows, and where risks can emerge. CUs that embed AI awareness into operations, service, and workflow planning reduce compliance pressure and launch smoother, safer digital experiences. (link)

Proactive AI helps stop holiday fraud before members feel the impact: AI analytics layered on top of existing fraud engines use consortium data to flag compromised cards, identify common points of purchase, and detect high-risk merchants long before suspicious charges appear. This lets Credit Unions reissue cards early, adjust rules in real time, and deliver the “non-event” fraud experience that preserves trust and loyalty. (link)

America’s Credit Unions meets with WOCCU to discuss AI challenges and more: America’s Credit Unions’ World Affairs Committee and the World Council of Credit Unions aligned on emerging regulatory risks such as AI, fraud, and digital currency. (link)

AI-powered fraud resolution is a member experience opportunity for Credit Unions: CUs score high on fraud detection (88%) but far lower on provisional credit (56%) and documentation (64%). Meanwhile, 79% of CUs lost over $500K to fraud in 2024. Agentic AI automates investigations, speeds provisional credit, and frees staff for empathetic member outreach. (link)

Meridian Credit Union launches AI financial wellness tools with Personetics: Meridian integrated Personetics’ cognitive banking engine into its new OnYourWay platform, giving 380,000 members personalized insights, budgeting tools, spending alerts, and savings recommendations. (link)

Experian warns of AI-driven cyber threats accelerating into 2026: The firm’s Data Breach Forecast cites over 8,000 global breaches in early 2025 and growing use of AI to create synthetic identities, autonomous malware, and harder-to-detect attacks. With 69% of U.S. adults doubting their bank’s readiness and one in four millennials hit by identity theft, Experian urges institutions to strengthen incident response. (link)

Take this AI readiness assessment to benchmark adoption progress: CU 2.0’s 48-point scoring rubric evaluates policy maturity, culture, data systems, workflows, and fintech partnerships to determine whether a Credit Union is beginning, developing, advanced, or leading in AI integration. (link)

Glia highlights how AI-powered virtual branches keep digital journeys human: A survey of more than 100 leaders found only 5% love their current contact center tech and 93% are ready to evaluate new options, even though just 21% have significant AI experience. Glia’s virtual branch model uses Voice AI and digital channels to offer 24/7 service, free agents from low-value calls, and extend reach without the $4M cost of new physical branches. (link)

Fifth Third partners with Brex to deploy AI-powered commercial finance tools: The multi-year deal unlocks $5.6B in annual commercial card payment volume and gives 8% of U.S. commercial banking clients access to Brex’s AI-native platform for issuing cards, automating expenses, and accelerating close. AI agents handle receipts, accounting, and spend controls in real time, reducing manual work and improving visibility for business customers. (link)

Freddie Mac issues new AI governance requirements for mortgage servicers: The update introduces a comprehensive framework for responsible AI and machine-learning development, mandating stronger requirements around transparency, accountability, and ethical oversight. (link)

BNY adds Gemini 3 to its enterprise AI stack to power agentic workflows: BNY is embedding Google’s Gemini 3 into its internal AI platform, Eliza, enabling employees to run agentic, multi-step workflows across onboarding, document analysis, risk checks, and more. Eliza currently supports 120 automated workflows. (link)

How gen AI experimentation turns uncertainty into an advantage: Treat gen AI as a portfolio of controlled experiments. Although many have adopted it, more than 80% report no earnings impact yet, while structured trials (like a 14% productivity boost and 34% gain for new agents) reveal where it truly works. Run staggered pilots on specific workflows before scaling to de-risk AI and target the highest-ROI use cases. (link)

How financial institutions can build private AI for speed, control, and compliance: With only 14% of organizations targeting enterprise-wide deployment by 2025, Rackspace says private-cloud AI offers a faster, safer path. Its FAIR framework helps teams spin up compliant gen AI environments quickly, align governance upfront, and move from prototypes to production without exposing sensitive data to public models. (link)

What the Concorde teaches about adopting AI responsibly: Dazzling tech doesn’t guarantee broad adoption, just as the supersonic passenger jet failed commercially despite its engineering brilliance. Leaders should avoid the “Concorde Fallacy” of pouring money into AI without clear ROI. Beware of risks like externalities (privacy, cybersecurity), human error, and poor implementation. (link)

Scottish Widows pilots AI to speed up marketing compliance reviews: The insurance and pensions firm is testing Adclear’s FCA-aligned review engine, which analyzes written, visual, and video content and cuts compliance review time by 88% while maintaining a full audit trail. The FCA is actively supervising the pilot. (link)

Gemini 3 turns AI into a no-code FP&A app builder: Gemini 3 Pro’s new Build/Canvas mode lets finance teams spin up interactive planning tools, like a CFO Decision Impact Simulator, in minutes from a single prompt, with everything running locally in the browser so sensitive data never leaves the device. (link)

Use this prompt for more reliable finance AI: Finance teams get burned by AI when they treat LLMs like black-box “answer machines” instead of tools that must interrogate assumptions first. Use this CFO “critical thinking” prompt to force AI to ask 7-12 targeted questions that reduce hallucinations by 80-90%. (link)

Agentic AI shifts from efficiency to experience design: Cornerstone’s Ron Shevlin and Stacy Bryant say AI is moving beyond back-office automation toward building end-to-end member experiences, from planning financial journeys to AI-assisted goal management. The shift means staff roles won’t disappear but will favor employees who pair AI fluency with creativity, while institutions that simply bolt AI onto legacy systems risk falling behind rising expectations. (link)

BBVA builds a conversational banking app inside ChatGPT: The bank now lets users ask natural-language questions about accounts, cards, and savings products directly through ChatGPT. Meanwhile, 11,000 employees already use OpenAI tools and report saving three hours per week. (link)

Bank of America deploys AI tool to answer complex payments questions in seconds: The internal GenAI system, trained on 3,200+ documents, lets staff answer client questions in seconds instead of hours by replacing manual searches and specialist calls. It improves turnaround times, surfaces best practices, and enables more tailored guidance across the Global Payments Solutions team. (link)

HSBC signs multi-year GenAI deal with Mistral AI:The multi-year deal gives HSBC access to Mistral’s commercial models to power internal tools for financial analysis, translation, procurement insights, and personalized marketing. Strengthening its self-hosted AI platform, the bank plans to extend these capabilities to fraud detection, AML, lending, and onboarding. (link)

RBC expects up to C$1B in enterprise value from AI by 2027: The bank reports that its Atom adjudication model, personalization engines, advisor and developer copilots, and redesigned mortgage workflows have positioned AI to generate C$700M-C$1B in enterprise value within two years. (link)

OpenAI report shows AI enabling entirely new employee capabilities: The State of Enterprise AI report finds 75% of workers say AI improves work speed or quality, and the same share say they can now complete tasks they previously lacked the skills or time to handle. Employees save 40-60 minutes a day on average, while heavy users reclaim more than 10 hours a week as advanced features like Projects and Custom GPTs scale. (link)

Funding Spotlight

Where the money is flowing for innovation…

Kobalt Labs lands $11M Series A to modernize financial institution compliance automation: Kobalt’s AI agents handle third-party risk reviews, internal audits, and marketing compliance for institutions including Meriwest CU, Emprise Bank, and Chime. (link)

Flex raises $60M Series B to scale its AI-powered private bank: Flex is building an AI-native platform that unifies credit, payments, ERP, and personal finance for business owners generating $3M-$100M annually. Its embedded agents span underwriting, payments, cash management, and ERP, feeding a unified “AI CFO” that automates complex financial workflows for high-value clients. (link)

Niobium raises $23M to build privacy-preserving chips for sensitive data: Niobium is developing hardware that lets organizations run calculations on encrypted data without ever exposing it, providing strong protection for financial and member information. (link)

Zafran secures $60M Series C for autonomous exposure-management AI: Zafran’s agentic system maps assets, detects vulnerabilities, and coordinates fixes automatically, cutting remediation times from weeks to hours. The funding comes as attackers now exploit new weaknesses within 24 hours, increasing pressure on organizations to adopt autonomous defense models. (link)

imper.ai raises $28M to fight AI impersonation attacks: Imper.ai is rolling out a real-time detection platform that flags deepfake voices, spoofed video, and social-engineering attempts across tools like Zoom, Teams, Slack, and Google Workspace. The system analyzes device and behavior signals to catch identity threats traditional scanners miss. (link)

Pine raises $25M Series A for autonomous consumer AI agent: Pine’s end-to-end agent negotiates bills, cancels subscriptions, secures refunds, books appointments, and handles calls and emails with a 93% success rate. Its shared-memory system learns from every interaction, making the network smarter as users offload more real-world tasks to automation. (link)

Keeping up with Tech

The latest in fintech and tools…

AI Platform Kobalt Labs aims to fix third-party risk for Credit Unions: The platform automates third- and fourth-party risk reviews by checking controls, scanning contracts, validating insurance, and mapping vendor dependencies in seconds. It provides exam-ready traceability and consistent scoring, helping large CUs cut manual workload and enabling smaller teams to handle TPRM, marketing compliance, internal audit, and policy reviews more efficiently. (link)

OpenAI tests “confessions” mechanism to expose hidden model errors: The feature generates a second, honesty-only output where the model flags hallucinations, skipped steps, instruction breaks, or reward hacking that may not appear in the main answer. Early tests show ~96% accuracy in catching misbehavior. (link)

LSEG and Nomura introduce ChatGPT integrations for market data workflows: LSEG will deliver its licensed financial analytics directly into ChatGPT, giving credentialed users real-time access to market data, news, and analytics while 4,000 employees adopt ChatGPT Enterprise for internal productivity. Nomura is blending its proprietary datasets with external sources via ChatGPT to enhance advisory work and develop new AI-enabled revenue models. (link)

Instacart brings fully integrated AI grocery shopping to ChatGPT: Instacart is now the first app to support full cart-building and Instant Checkout directly inside ChatGPT. Powered by OpenAI’s Agentic Commerce Protocol, it connects real-time store data, personalized suggestions, and Instacart’s fulfillment network to streamline end-to-end ordering. (link)

Ramp builds petabyte-scale AI data cloud for company-wide insights: Ramp connected sales calls, emails, tickets, invoices, and other unstructured data into Snowflake Cortex so any employee can query it in plain English. The system speeds decision-making across teams, but misclassified insights or incorrect summaries could pose legal and compliance risks for regulated organizations. (link)

OpenRouter releases large-scale study on real-world AI usage trends: The report analyzes more than 100 trillion tokens of developer traffic across 300+ models and shows a major shift toward agentic workflows. With reasoning models and open-source options rapidly gaining share, future applications will rely less on static chat and more on end-to-end AI agents. (link)

In Other News

Related news you can learn from…

7 trends shaping AI’s next phase in 2026 (link)

FCA begins live testing of AI in UK banks (link)

Anthropic and OpenAI are racing to their IPOs (link)

Why some AI products achieve extraordinary early retention (link)

OpenAI is now in “Code Red” to compete with Google’s Gemini (link)

Could a “10% for the People” AI dividend prevent a future economic underclass? (link)

Community Corner

Memes and visuals…

Thanks for reading!

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!