Big data vs AI? Credit Unions discover they work best together | 11/20

Plus: Banks are keeping up with Fintech, serving staff with AI, and more!

Fintechs just had a heck of a week, raising $1.5B globally.

But the question is: Are financial institutions staying agile enough to compete?

If you’re new here, I find the hottest AI news for Credit Unions to bring you practical insights in a quick, digestible weekly newsletter.

Today, I cover:

Big Data vs AI? Credit Unions are discovering the two work best together

Banks race ahead of Fintechs in AI race

How 4 banks are serving employees with AI

Read time: 9 minutes

Top Stories

The biggest news this week…

1) Big data vs AI? Credit Unions are discovering the two work best together

On a recent CU 2.0 podcast, Anne Legg of Thrive 3.0 and Saroop Bharwani of Senso argued that “big data versus AI” is the wrong question for Credit Unions. “Big data is food for AI,” Legg said, stressing that agents perform best when they have full context: structured core data plus unstructured knowledge like SOPs, PDFs, call logs, and chat transcripts. Bharwani added that with only core data, “you’re only looking at one half of the whole picture,” and that a unified context layer lets agents actually use that information in real workflows.

Senso’s Credit Union clients like One Nevada, TruStone, Suffolk, and Arrowhead used this unified context layer to boost response quality from roughly 30% to 91%, cut 10-minute answer hunts down to about a minute, and turn every call or search into “organizational memory” instead of tribal knowledge. Echo, Senso’s AI call-analysis agent, now reviews 100% of calls in seconds, versus a human QA team that could only log ~1% manually. Thrive 3.0’s cohort of smaller institutions — some around $100M in assets — used shared data workflows to pull a targeted credit card offer and generated 30,000 in new balances in six weeks.

For staffing, both guests argued “automation leads to elevation,” not automatic layoffs. Collections agents at one Virginia Credit Union happily moved out of repetitive, confrontational work as AI took first-line calls, while leaders re-deployed staff to higher-value tasks.

With megabanks like JPMorgan Chase and Bank of America investing heavily and widening the efficiency gap, Legg urged Credit Unions to stop “building rocket ships” and instead “build a bike that moves faster” by starting with small, member-focused use cases and a clear AI + data governance strategy. (link)

2) Banks race ahead of Fintechs in AI race

In an interview with OpenAI’s Jenny Johnston, Rex Salisbury admits something Credit Union and community bank leaders won’t love: major banks are adopting AI faster than the Fintechs meant to disrupt them. It took banks 16 years to embrace cloud cores after AWS launched in 2005. This time, Johnston says they’re jumping on AI in a matter of months because it tackles their biggest pain points: manual processes, costly expert labor, and messy legacy systems.

Morgan Stanley is the clearest proof. Its wealth division now runs on “the smartest intern they’ve ever hired that never gets tired,” a private assistant that preps meetings and surfaces answers so advisors can focus on clients. Under the hood, the bank has pushed about 9 million lines of COBOL (Common Business-Oriented Language) through OpenAI’s reasoning models to generate human-readable specs, saving an estimated 280,000 engineering hours and $30M+ as they modernize their core stack.

Other giants are moving fast. BBVA, with 125,000 employees, has created more than 3,000 internal GPTs in just a few months, including a branch manager assistant that helps a nine-person team handle roughly 40,000 policy questions a year. BNY Mellon’s 50,000 staff use its Eliza platform for legal review and compliance work (after completing mandatory training). And Santander has shifted from its custom AI stack to ChatGPT Enterprise, rolling it out to about 15,000 employees and already seeing 20-30% productivity gains in legal, compliance, and finance.

Johnston predicts AI access inside banks will jump from low single digits to nearly universal within 12 months. The winners will 1) give AI to everyone instead of just small pilots, 2) make AI use culturally celebrated from the top down, and 3) start now instead of waiting for the “perfect” model. As she puts it, “the models today are the dumbest they will ever be.” (link)

3) How 4 banks are serving employees with AI

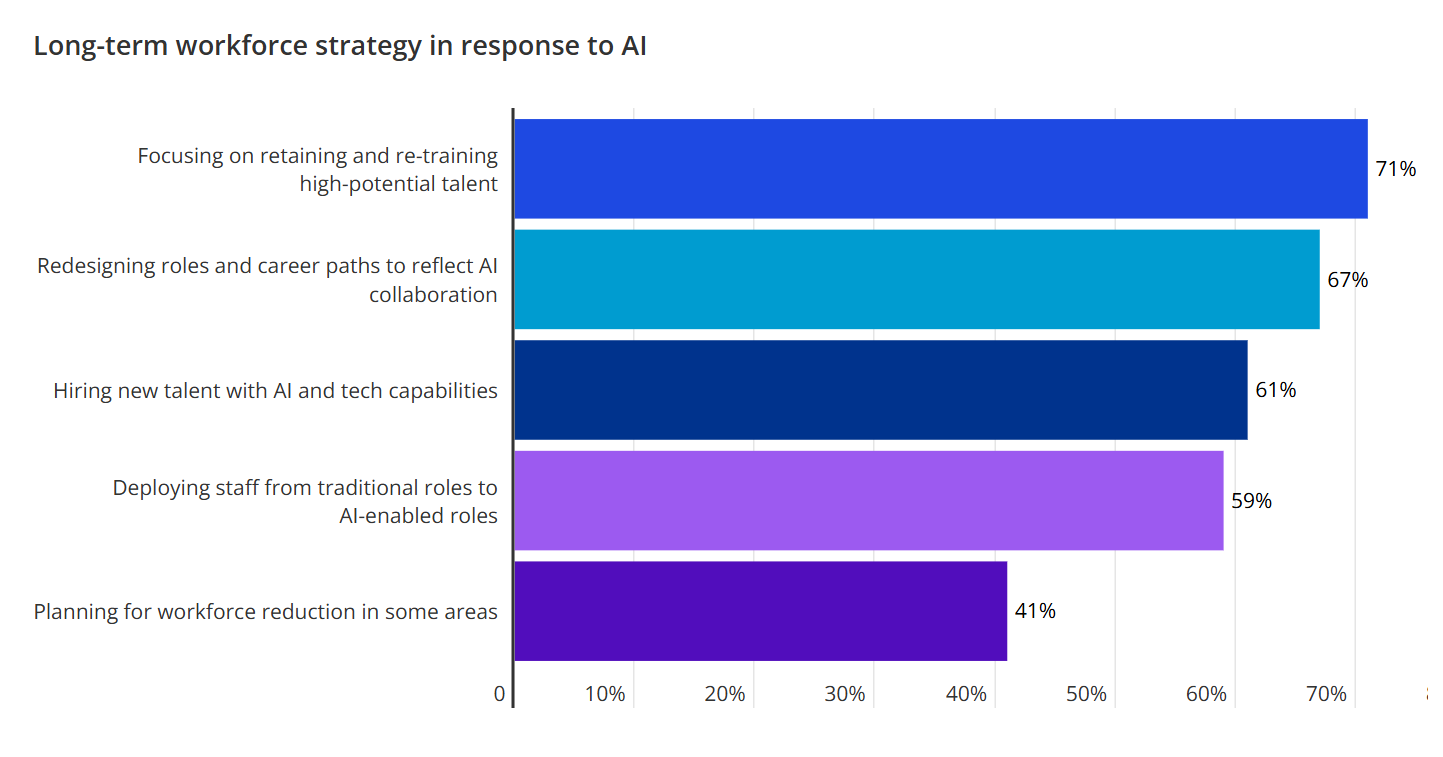

For all the talk about AI replacing jobs, four banks on American Banker’s Best Banks to Work For list tell a different story: AI is becoming a workplace upgrade. In a new KPMG survey, 71% of executives plan to retrain their entire workforce on AI. At Potomac Bank, Capital Bank, Ledyard National Bank, and BankPlus, AI is now reshaping how employees get answers, learn, and do their work.

1/ Potomac Bank used Microsoft Copilot to analyze multiple years of Best Banks to Work For survey results, saving their HR director hours to focus on an action plan. The bank is now using AI to help rewrite and manage SOPs, onboard new hires faster, and even produce sales and training materials.

2/ Capital Bank built Capital Bank GPT, an internal AI assistant that searches all policies, procedures, and internal data so employees can instantly answer questions like “What’s our family-leave policy?” They’re also rolling out AI-driven training builders so employees can create custom training programs based on internal and external data.

3/ Ledyard National Bank has taken a cautious but structured approach, forming an AI Task Force and upgrading to Microsoft Copilot while blocking consumer tools like ChatGPT for security reasons. The team is building workflows that pull all policies and SOPs into a single AI-searchable layer.

4/ BankPlus has gone all-in on AI-powered communication. Its platform can turn one message into an employee’s preferred format, whether a podcast, an animated slideshow, or a document. A new AI intranet also replaces a maze of outdated content with instant, accurate answers. Meanwhile, a predictive AI inside its ticketing system now anticipates employee needs and resolves issues faster. (link)

Tips & Use Cases

Learn to apply AI…

4 Credit Union cybersecurity moves to fight rising AI threats. IBM Security reports an average global data breach cost of $4.4M in 2024 and a 97% spike in AI-related incidents. CUs must strengthen phishing training, enforce multi-factor authentication, maintain immutable backups, and monitor cloud access continuously to reduce ransomware risk. (link)

OpenAI finds AI matches or exceeds humans in 49% of 44 professions analyzed: The top three, ranked by AI’s performance score, are project management (52%), software development (50%), and audiovisual production (50%). (link)

AI leadership is becoming a required role, not a nice-to-have: As AI reshapes lending, marketing, fraud, and member service, CUs are shifting from ad-hoc pilots to appointed owners of strategy, compliance, workflow automation, and staff training. Depending on size, this may be a Chief AI Officer for long-term governance or a hands-on Director of AI Innovation. (link)

You don’t need to use private data for your biggest AI wins: Most teams can start using tools like ChatGPT or Copilot with anonymized reports, branch metrics, and publicly available datasets. AI can summarize performance, surface trends, test ideas, generate visuals, and act as an always-on analyst that helps staff make faster, better decisions without touching member PII. (link)

Personalization at scale is now achievable with AI agents: Agentic platforms like Uptiq unify member data, anticipate needs, and deliver timely, relevant outreach across chat, mobile, and voice. CUs can automate proactive alerts, next-best offers, and staff insights that deepen relationships and lift retention. (link)

How people-first AI supports frontline staff with real-time support: With 46% of banking customers now expecting timely, contextual advice, and fraud losses topping $16B in 2024, CUs are turning to AI assistants that surface policy-cited answers, next-best-actions, and early fraud-review cues in real time. (link)

AI can turn financial statements into insights and narratives in minutes: With Copilot in Excel and the new “=LABS.GENERATIVEAI()” function, finance teams can flag anomalies, explain variances, and generate management-ready commentary directly inside the spreadsheet. (link)

AI adoption is accelerating, but data silos remain the biggest blocker: A global survey of 155 financial services leaders finds that nearly half are stuck between pilots and full deployment, with 97% citing fragmented data as the top hurdle. 62% adopt hybrid AI models, which they rate as highly valuable. (link)

Eurobank moves to embed agentic AI across core banking operations: Eurobank is partnering with Fairfax Digital, EY, and Microsoft to deploy a scalable agentic AI system that automates core workflows, enabling real-time decision-making and personalized service. (link)

Agentic AI moves from pilots to live financial decisions: Capital One, Visa, and RBC are already using AI agents to help customers buy cars, move money, and execute trades with little or no human help. (link)

AI is learning bank jobs faster than institutions can adapt: AI is taking over routine analysis and real-time operations while humans focus on judgment. Leading the way, BNY has trained 99% of staff on its agentic platform, making governance and human oversight essential as roles evolve. (link)

Bank of America drives measurable revenue and cost savings with AI: Erica has handled 3 billion interactions, equal to the work of 11,000 staff. AI is helping bankers handle 50 clients instead of 15 by helping them prep for client meetings, predict call needs, screen for fraud, and more. (link)

How large banks are prepping for AI agents to lead bank processes: JPMorgan Chase, Citi, and BNY are preparing for agentic AI by upgrading data governance, refining smaller task-specific models, and designing new oversight systems. According to a Capgemini survey of bankers, top use cases include customer service (75%), cards and payments (64%), fraud detection (64%), loan processing (61%), and customer onboarding (59%). (link)

Temenos leans on explainable AI agents to help banks modernize safely: CPO Sai Rangachari says banks stuck on legacy cores need progressive modernization supported by conversational co-pilots and AI agents for fraud, payments, and compliance that begin in passive, explainable, human-in-the-loop modes. The company is also using AI to reduce implementation and upgrade time, aiming to cut product launches from months to days. (link)

AI research converges on how people actually use generative tools: Three major studies from OpenAI, Anthropic, and social listening show usage is growing rapidly and clustering around a small set of high-impact tasks, with 78% of all activity concentrated in just three categories. (link)

Funding Spotlight

Where the money is flowing for innovation…

ABA invests in PortX to accelerate AI-powered data integration for Credit Unions: The funding will expand PortX’s middleware platform, modernize legacy systems, streamline Fintech partnerships, and enable faster digital transformation. (link)

Ramp raises $300M at $32B valuation to expand its AI finance agents: The funding will scale Ramp’s platform, which automates expense controls, AP workflows, and real-time financial decisions. Ramp automated more than 26 million decisions last month alone. (link)

Federato raises $100M Series D to scale its AI-native insurance platform: The funding will accelerate product development and global expansion of its agentic underwriting system, which embeds into existing workflows to modernize the full policy lifecycle. (link)

Maybern raises $50M Series B to build AI infrastructure for private funds: The round will accelerate development of its AI-native fund-operations platform, which unifies performance and investor data to replace spreadsheet-heavy workflows. The system supports automated reporting, stronger controls, and real-time analytics across the $16T global alternatives market. (link)

FALKIN raises $2M pre-seed to strengthen AI scam-prevention tools: The London-based Fintech is enhancing its AI safety layer that detects manipulation in messages and payment requests inside digital banking apps. FALKIN is also launching Safety Labs to help community banks and Credit Unions deploy scam-prevention tools more easily. (link)

Avalara secures $500M investment to advance its agentic tax-automation platform: The BlackRock-led round will strengthen Avalara’s AI-powered tax and compliance platform, which automates filings, calculations, and certificate management for 43,000+ customers using embedded review checkpoints and enterprise-grade infrastructure. (link)

Zilch raises $176.7M to grow its AI-powered payments platform: Led by KKCG, the new debt and equity round will fuel Zilch’s product growth and market expansion as it scales to 5.3M users and rolls out new AI-driven offerings like Intelligent Commerce and Zilch Pay. (link)

Sweet Security raises $75M Series B to expand its runtime AI-security platform: The cloud security company is expanding globally and adding real-time protections for cloud workloads, models, and agents. Sweet Security reports 6x ARR growth and a 10x increase in enterprise clients as demand for runtime-first protection rises. (link)

Adclear raises €2.4M seed to build out its AI-powered FinProm compliance platform: With the new funding, Adclear is scaling its AI system that automates compliance reviews for financial promotions and marketing materials. Adclear reports cutting review times by 88% as financial brands process growing volumes of digital content. (link)

Anzen raises $16M Series A to scale its AI-powered commercial insurance platform: Anzen is expanding Anzen Pro, its AI workspace that structures submissions, automates quoting and placement, and reduces agent overhead by 30% while supporting deeper carrier integrations. (link)

Greenshoe raises $3M seed to build its AI-native SEC reporting platform: Greenshoe, which cuts 180+ hours of manual work per 10-Q, is using the round to scale its AI-driven system that automates drafting, validation, and compliance checks for SEC filings. (link)

Self raises $9M Seed to expand its zero-knowledge proof-of-humanity platform: To meet rising demand for privacy-preserving identity verification, Self is scaling its zero-knowledge proof layer and onboarding via biometric passports and national IDs from 160+ countries. (link)

Keeping up with Tech

The latest in fintech and tools…

Finzly rolls out agentic AI to modernize Credit Union payment workflows: The AWS-built agents automate repetitive tasks like OFAC screening and payment verification — where 98% of alerts are false positives — using human-in-the-loop oversight to maintain regulatory compliance. The system connects to existing cores like a “Lego block” and supports ACH, Fedwire, RTP, FedNow, and Swift to reduce errors and streamline legacy payment operations. (link)

OpenAI launches GPT-5.1 with adaptive reasoning and faster performance: GPT-5.1 is now 2x faster on simple tasks and more accurate on complex ones, with improved instruction following and better results in math and coding. New tone controls also make it easier for teams to standardize style across responses. (link)

Google introduces Gemini 3 with major accuracy and reasoning gains: Gemini 3 Pro now tops AI leaderboards with a score of 1501 and reaches 81% on multimodal tests that measure reasoning across text and images. Its Deep Think mode boosts results even further. The model is rolling out across Search, the Gemini app, and Vertex AI. (link)

SS&C launches agentic AI to streamline credit processing and contract workflows: The managed service uses AI agents to update loan and contract documents in near real time, reducing manual work and errors. Early testers like American Life & Security report faster credit processing as SS&C validates the agents internally before broader rollout. (link)

Grasshopper launches ChatGPT-enabled AI banking tools with Narmi: The bank expanded its MCP (secure data-exchange system) with new read-only connections that let businesses safely link their accounts to ChatGPT and Claude without sharing login credentials. With ChatGPT now used by 800 million people weekly, Grasshopper and Narmi say this creates a new, secure channel for conversational banking. (link)

interface.ai launches BankGPT, the first agentic AI platform for Credit Unions: Proven across billions of banking interactions, BankGPT combines LLMs with grounded knowledge and end-to-end action through voice and chat, enabling higher self-service and faster resolution for early adopters. The rollout adds Agentic Voice AI and the Assemble admin console, giving institutions tighter control over routing, authentication, governance, and integrations. (link)

Investing.com launches Vision-powered AI that builds trading plans in <60 seconds: The new feature uses Vision AI to read charts like an analyst, detecting candlestick patterns, key levels, and indicator signals. Early testers report completing research up to 10x faster. It’s rolling out globally to 60 million monthly users across 30 language editions, generating full entry/exit plans and clearer risk-reward guidance in seconds. (link)

Ant International launches EPOS360, an AI merchant platform for MSMEs in Singapore: Micro, small, and medium enterprises can now use the EPOS360 app to manage payments, banking, lending, and marketing in one place, with instant loan approvals up to 5,000 SGD (Singapore dollars). Launching in Singapore and Malaysia in 2026, the platform integrates with ANEXT Bank and already supports more than 6,000 merchants across Southeast Asia. (link)

Primer launches AI Companion, an agentic assistant for payments teams: The tool analyzes 400+ data points per transaction to surface contextual recommendations, answer real-time questions, and automate approved actions that improve authorization rates and reduce processing costs. It’s now rolling out across the Primer platform, giving lean payments teams an AI partner that manages performance and risk across global commerce. (link)

Haiqu tests quantum method that outperforms classical fraud detection models: Its model compressed 500+ transaction variables into 128 qubits to uncover subtle anomalies that classical tools miss. Accuracy remained high with an F1 score of 0.98 in simulations and 0.96 on hardware, beating legacy classical baselines of 0.90-0.93. (link)

In Other News

Related news you can learn from…

Singapore proposes AI rules holding bank leaders accountable as 35,000+ staff retrain (link)

GPT-5 tests reveal accuracy gaps on real-world document edge cases (link)

TNG eWallet and Easypaisa adopt Alipay+ GenAI platform for AI agents (link)

GenAI funding jumps >8x to $33.9B as global AI investment hits $252.3B (link)

Community Corner

Memes and visuals…

Thanks for reading!

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!