ChatGPT bans financial advice amid liability concerns | 11/6

Plus: how CUs automate 84% of calls with Voice AI, cut collection costs by 54%, and more!

Welcome back to Credit Union AI Guy!

If you’re new here, I find the hottest AI news for Credit Unions to bring you practical insights in a quick, digestible newsletter. Every. Single. Week.

Today, I cover:

ChatGPT barred from giving financial advice amid liability concerns

How Securityplus FCU automates 84% of calls without burning member trust

How First City CU cut collection costs by 54% and relies less on third parties

Read time: 7 minutes

Top Stories

The biggest news this week…

1) ChatGPT barred from giving financial advice amid liability concerns

OpenAI has redefined ChatGPT as an “educational tool,” blocking it from giving financial advice as regulators intensify scrutiny over AI accountability. More specifically, OpenAI is now banning “automation of high-stakes decisions in sensitive areas without human review,” including “financial activities and credit.“ ChatGPT can still explain general principles, like ETFs and how taxes work, but now redirects users to licensed professionals, preventing prompts that request investment guidance.

The move highlights the growing need for AI governance and risk controls as generative tools enter regulated environments. Member-facing AI chatbots must be transparent about their abilities, ensuring educational support doesn’t cross into regulated financial advice or decision-making.

Credit Unions relying on general-purpose AI tools like ChatGPT, may need to adapt by investing in purpose-built AI tools for sensitive financial guidance, planning, or compliance use cases. As foundation models retreat from high-stakes use, the next phase of AI in finance will hinge on verticalized partners who can meet industry-level accountability standards. (link)

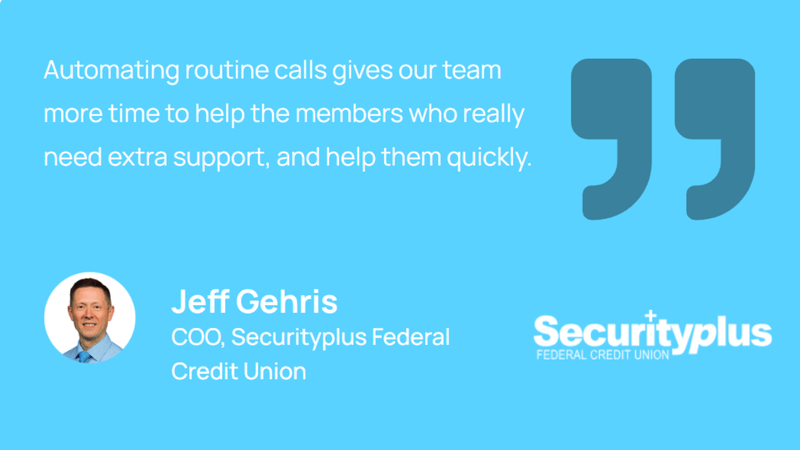

2) How Securityplus FCU automates 84% of calls without burning member trust

When Securityplus Federal Credit Union’s legacy IVR system was sunset, they faced a crossroads: replace it with another rigid menu system OR revamp the member experience entirely. Instead of sticking with outdated “press 1, press 2” call trees, the Baltimore-based Credit Union deployed Interface.ai’s Voice AI Agent to deliver conversational service that could actually understand and resolve member requests.

To smooth the transition for members, Securityplus blended familiarity with the new AI. Members still heard the same numeric menu, but behind option one, their call seamlessly transferred to the AI Agent. That subtle rollout eased hesitation and allowed members to experience the value it provides for themselves.

Since launch, the AI system has automated 84% of incoming calls, achieving 92% member adoption and contributing to 6% membership growth. The Voice AI now handles routine inquiries like balance checks, transfers, and branch information, while employees spend more time guiding members, assisting with loans, and deepening engagement. (link)

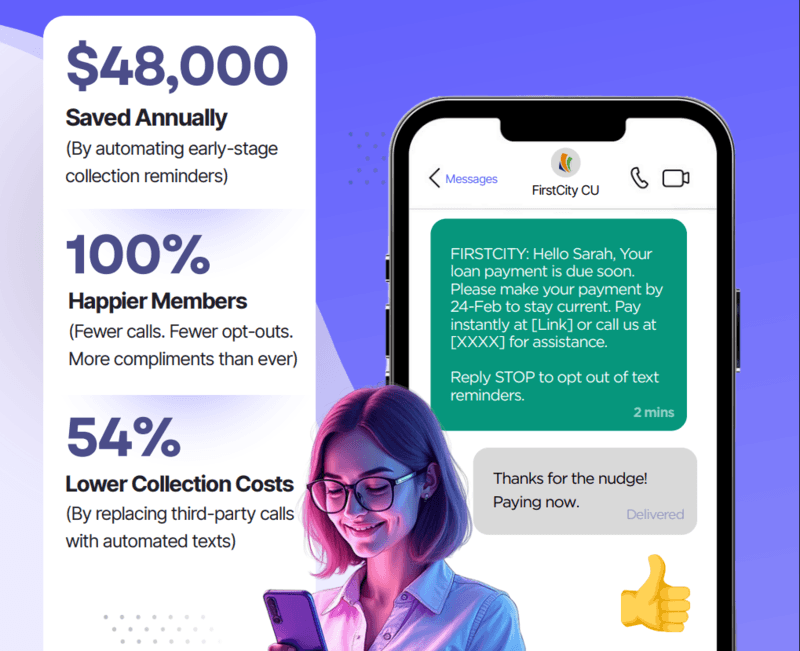

3) How First City CU cut collection costs by 54% and relies less on third parties

By integrating Eltropy’s AI-powered messaging with Akuvo’s collections workflow, First City Credit Union replaced manual collection calls with automated text reminders, cutting third-party collection costs by 54% — saving $48,000 annually. Staff no longer need to make early-stage payment reminder calls, since Akuvo handles all early-stage payment reminders, and they only have to rely on a third party for 20 to 30 days.

The AI-powered workflow triggers personalized texts with embedded payment links at key intervals, allowing members to pay instantly while maintaining privacy and control. Member feedback has been overwhelmingly positive, with fewer opt-outs, faster cures, and record levels of compliments for staff. (link)

Tips & Use Cases

Learn to apply AI…

5 AI use cases Credit Unions can deploy today: Cornerstone Advisors says you can drive measurable ROI by implementing AI for automated lending, customer support, risk management, agentic payments, and back office operations. (link)

Explain your AI, or risk losing member trust: As AI shapes more lending decisions, make outcomes explainable to members, show how data is used, and keep humans in the loop to give automation a personal touch. (link)

Make AI part of your 2026 strategy or risk falling behind: CU 2.0 says most Credit Unions are still stuck using AI for simple tasks like drafting emails. Meanwhile, leaders are already orchestrating agents to automate social engagement, generate reports from databases, and update their CRM with a click using natural language. (link)

How to turn GenAI uncertainty into a strategic edge: Over 80% of companies using GenAI say it hasn’t boosted earnings yet, but researchers found that small, structured experiments reveal where it actually delivers an ROI. (link)

How to scale multilingual communication with AI: With over 25 million Americans having limited English proficiency, AI-powered Customer Communications Management platforms let you deliver accurate, culturally aware member communications at a fraction of traditional costs. (link)

Reseda Group and Maps Credit Union acquire a fast-growing fintech platform: By acquiring Pocketnest’s AI and behavioral science platform, they hope to build the future of hyper-personalized AI banking with coaching for budgeting, retirement, debt, and more. Members using the tool have seen a 57% boost in financial wellness on average. (link)

AI success depends on people, not platforms: At the REACH Conference, James Robert Lay urged Credit Unions to focus on culture, clarity, and adaptability over technology alone, warning that confusion leads to burnout and member churn. (link)

BECU acquires an AI fintech company to boost financial wellness: The purchase of EarnUp brings in a 13-person AI team and its former CEO to accelerate development of AI-powered financial advisors that replicate the personalized guidance of humans. (link)

Why compute is the new balance sheet: With humanoid robots, brain-like chips, and AI-native infrastructure reshaping the economy, and OpenAI projecting superhuman-level AI models by 2026-2028, CFOs must treat AI and compute as core capital investments to stay competitive in an intelligence-driven financial system. (link)

Lloyds finds over half of UK adults now use AI to manage money: 28.8 million Brits used AI tools for budgeting, investing, or financial planning in the past year, saving an average of £399 annually. Yet 83% still worry about privacy and 80% about accuracy. (link)

BNY now has 110 AI solutions in production: Nearly 100% of BNY employees are now AI-trained, with its internal platform “Eliza” powering AI tools to accelerate payments, reduce repairs, and enhance service quality with human oversight. (link)

Despite growing investments in tech, Credit Unions are still lagging: Many Credit Unions report just 10-15% of accounts come through online channels, with the main challenge being a poor onboarding experience. Addressing fraud risks, legacy tech, and manual processes is key to meeting younger members’ demand for seamless, AI-driven onboarding. (link)

AI reconciliation tool cuts Credit Union close time by 90%: Credit Unions using ReconArt’s AI-powered reconciliation platform have shortened monthly close time from 40 hours to 4, eliminated 80% of manual data entry, and achieved ROI within 6 months. The system automates matching and exception handling across ACH, ATM, and Fed Reserve accounts. (link)

AI tools take center stage as Credit Unions race to stay relevant: At the REACH 2025 Fintech Solutions Showcase, solutions from Glia, Transvision, and Upstart showcased how AI can power contact centers, automate fraud detection, and transform member acquisition and retention. (link)

How AI lending can unlock millions in new income: Credit Unions using AI-driven lending see approvals rise 15-40 points, loss rates improve by up to 25 basis points, and 60-80% of decisions made instantly, adding $1.5M-$10M in annual net interest income. (link)

How AI can unlock the next wave of Credit Union growth: Fintechs now hold 45% of new primary banking relationships, leaving Credit Unions behind. Real-world results like 95% fraud detection accuracy, 70% faster loan processing, and massive engagement gains at Wellby and Central Willamette prove AI can close the gap. (link)

How Wells Fargo is rebuilding for the agentic AI era: The bank is embedding agentic AI into its core workflows to execute tasks like contract reviews, KYC checks, and debit card replacements under human oversight. Wells Fargo is also building an enterprise-wide AI platform for all employees and preparing for agent-to-agent banking, where authenticated “AI buddies” conduct transactions securely. (link)

Funding Spotlight

Where the money is flowing for innovation…

Uptiq.ai raises $12M to accelerate compliant AI adoption in financial services: The round led by Silverton Partners will scale Uptiq’s Qore platform, which lets banks, Credit Unions, and fintechs deploy AI in lending, advisory, and compliance workflows in weeks instead of months. (link)

Reflectiz secures $22M Series B to expand AI-driven web exposure management: The company will scale its platform that detects and analyzes third-party scripts and open-source code for vulnerabilities and expand partnerships across finance, e-commerce, and healthcare. (link)

FundPark raises $71M to expand AI-driven “Scale-Up as a Service” platform: The Hong Kong-based company secured funding from Ares Management, Alpha Nova Capital, and Radiant Tech Ventures to enhance its AI-powered financing and insights platform for eCommerce sellers and accelerate global expansion. (link)

Sublime Security raises $150M to scale agentic AI email defence: The Series C round led by Georgian, with Avenir, 01A, and Citi Ventures, will accelerate development of Sublime’s autonomous AI that detects, triages, and neutralizes evolving email threats in real time. (link)

Grasp raises $7M to automate complex financial work with multi-agent AI: The Swedish fintech’s Series A round led by Octopus Ventures will fund global expansion and product development of its AI platform that automates analyst tasks in banking, private equity, and consulting. (link)

Paygentic raises $2M to build flexible billing for AI-native payments: The pre-seed round led by MiddleGame Ventures will fund development of Paygentic’s platform for hybrid, usage-based, and outcome-based pricing models, replacing legacy billing systems that can’t adapt to the dynamic needs of AI-driven businesses. (link)

Polygraf AI raises $9.5M to secure trusted, locally deployed AI systems: The seed round led by Allegis Capital will accelerate development of Polygraf’s Small Language Model architecture for defence, intelligence, and financial sectors, delivering on-prem AI that protects against deepfakes, data leaks, and insider threats. (link)

ConductorOne raises $79M to scale AI-native identity security platform: The Series B round led by Greycroft, with backing from CrowdStrike and Accel, will expand ConductorOne’s unified IGA, IAM, and PAM platform that manages human, non-human, and AI identities with advanced automation and analytics. (link)

Keeping up with Tech

The latest in fintech and tools…

Starling launches AI-powered scam advisor with Google Cloud: The UK bank’s Scam Intelligence tool uses Google’s Gemini models to analyze marketplace ads and messages for fraud signals, helping customers detect scams and reduce losses that topped £450 million in 2024. (link)

ESW unveils Agentic Hub to power intelligent, adaptive global commerce: Launching in early 2026, ESW’s platform will let brands build self-learning AI agents for ecommerce, payments, and support using Model Context Protocol (a secure way to connect AI with external data). (link)

SunTec debuts AI-augmented account analysis platform for smarter treasury insights: The Xelerate Account Analysis Solution uses AI to analyze account data, simulate pricing scenarios, and generate audit-ready proposals. (link)

PayPal launches agentic commerce platform with OpenAI: The payments giant’s Agentic Commerce Services and “agent ready” tools integrate with OpenAI and Google, enabling merchants to process AI-initiated checkouts and agent-driven payments. (link)

AWS and OpenAI sign $38B deal to expand AI infrastructure: The 7-year partnership gives OpenAI access to AWS’s EC2 UltraServers with hundreds of thousands of NVIDIA GPUs and scalable compute reaching tens of millions of CPUs to train and deploy next-generation generative and agentic AI models. (link)

OpenAI launches GPT-OSS-Safeguard for customizable AI safety policies: The open-weight models (120B and 20B) let developers apply and audit custom safety rules in real time, offering transparent reasoning to improve moderation accuracy. (link)

In Other News

Related news you can learn from…

Report finds 68% of UK startups lack board-level AI expertise (link)

Insurers add generative AI exclusions as startups launch new coverage (link)

AI dominates opening day at Money20/20 USA (link)

Wharton-GBK’s report shows enterprise AI being driven by ROI instead of hype (link)

Community Corner

Memes and visuals…

Thanks for reading!

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!