Cobalt CU’s 83% session containment with AI Voice | 1/8

Plus: how ConnectOne is preserving white-glove service, why AI won’t ship on legacy cores, and more!

Good news: Cornerstone Advisors’ Data EQ study found Credit Unions outscore banks in how effectively they use data. 👏

The catch? Many institutions still lack the integrated data foundation (core + digital channels + clean, accessible data) that AI needs, leaving a lot of opportunity on the table.

Today, I cover:

Cobalt Credit Union achieves 83% session containment with Eltropy AI Voice

ConnectOne Bank is using AI internally first while preserving white-glove service

Why AI won’t ship on legacy cores

Read time: 7 minutes

Top Stories

The biggest news this week…

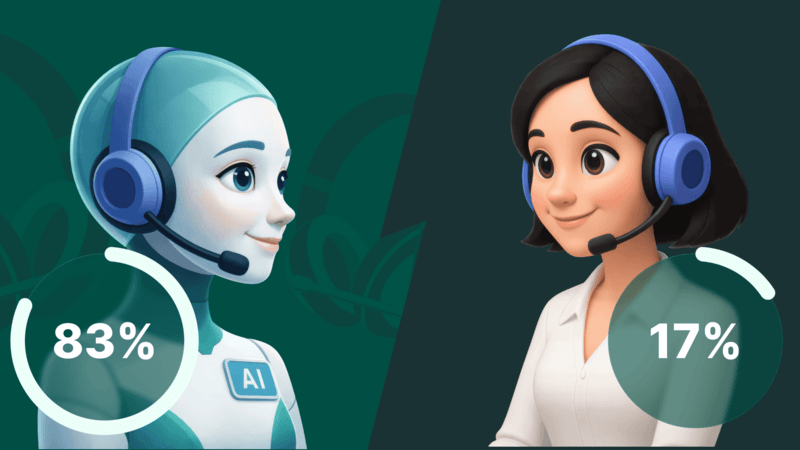

1) Cobalt Credit Union achieves 83% session containment with Eltropy AI Voice

Cobalt Credit Union serves 116,000 members, many of whom are military members stationed around the world, so 24/7 support isn’t a nice-to-have. Instead of jumping straight to voice AI, the Credit Union built toward it in phases: starting with video banking through POPi/o (now part of Eltropy), expanding into chat and text messaging, and only then layering in AI once members were already used to engaging digitally across channels.

That staged rollout continued in August 2024, when Cobalt launched its first AI intent-based assistant “Coby” alongside a new digital banking platform. Two months later, it added generative AI so Coby could handle a broader range of questions. The latest step, Eltropy AI Voice, completed the multi-channel strategy, now hitting a 83% session containment rate while being able to take actions, like handling authentication, processing transactions, and providing confirmation.

As Cobalt’s VP of Digital Banking Chasmine McIntosh put it, “[Coby] frees up our team to focus on the complex situations where members really need that human touch.” (link)

2) ConnectOne Bank is using AI internally first while preserving white-glove service

On the Banking Transformed Podcast, Jim Marous interviewed ConnectOne Bank’s Siya Vansia, where she explained why her team is starting with AI behind the scenes, not in front of customers. For the $14B commercial bank that’s quickly grown since being founded in 2005, their brand promise is “white glove service.” That’s why Vansia says they’re being deliberate about where AI shows up: “If we were to expose AI to our clients, we should be really thoughtful about it.”

So the first AI priority is internal: admin support, content creation, marketing, and research, aimed at eliminating the manual “zombie work” that eats up back-office time. Vansia also called out near-term value in stronger fraud monitoring and in using AI to scour internal data faster during high-stakes moments like a data leak. The point isn’t to bolt AI onto old workflows. It’s to reimagine a process, which is why she emphasized aligning teams on outcomes early and defining success up front with partners (“measure twice, cut once”). (link)

3) Why AI won’t ship on legacy cores

Temenos CPO Sai Rangachari has made a great point: banks aren’t struggling to “productionize AI” because AI is uniquely hard. They’re struggling because shipping anything is hard when your core is a constraint. As Jim Marous says, “you can’t operate a digital institution with a core system that hasn’t been updated since before the iPhone was introduced.”

Rangachari calls the current wave of pilots “innovation theater,” arguing many institutions can’t get any project to production, nonetheless AI, which is why “pilots at scale… never see the light of day.” Temenos says it’s investing in three buckets: 1) conversational copilots embedded inside banking products, 2) autonomous agents that start in “listen-only” and human-in-the-loop modes until trust is proven, and 3) AI that reduces upgrade/lifecycle pain by analyzing custom code and version changes.

His most concrete example: a financial crime mitigation agent at a Tier 1 European bank reportedly reduced false positives by ~30%, redeployed ~15-25 staff to higher-value work, and only moved to autonomy after achieving 99%+ accuracy through staged rollout. (link)

Tips & Use Cases

Learn to apply AI…

How Credit Unions and fintechs team up for AI-enabled banking: PYMNTS Intelligence finds 66% of FinTechs see Credit Unions as clients and 9 in 10 as collaborators. AI underwriting partnerships like Scienaptic AI + Kentucky’s Credit Unions show how CUs can modernize decisioning and expand access at scale. (link)

AI helps Credit Union marketers scale content without losing voice: Many Credit Union marketers use tools like ChatGPT for brainstorming, editing, repurposing content across channels, and jumpstarting research. But humans must stay in charge of strategy, final copy, and keeping confidential information out of public AI tools. (link)

4 AI imperatives for banking CMOs in 2026: BCG finds only 15% of marketing AI runs cross-functionally at scale, so CMOs should redesign end-to-end creative and media workflows. Agentic AI is expected to take ~20% of all marketing work within 2-3 years, pushing Credit Unions to reset agency roles and refocus teams on strategy. (link)

CRE lenders use AI to surface hidden risk, not loosen standards: Lenders are applying AI to flag grey-area deals, concentration risk, and early warning signals that traditional models miss, while keeping humans in the loop to meet regulatory and trust requirements. (link)

Cornerstone Advisors benchmarks Data EQ for AI readiness: A survey of 124 institutions finds Credit Unions score 271/500 on Data Execution Quality vs banks at 211/500. 35% already use chatbots, and 25% use generative AI, but the report warns weak data execution makes AI underperform. (link)

AI becomes a default work tool, but governance lags: A PYMNTS survey found about 70% of AI-using employees say their employer now encourages AI use, but only ~30% report mature controls for approvals, disclosures, and quality monitoring. (link)

How to level up your AI productivity in 2026: If you’re stuck at using AI as a “search substitute” like ~25% of users, you’ll only gain 1-3 hours/week. To reach 3-6+ hours/week, start every project by uploading context, go three follow-ups deeper, ask for alternatives, and force AI to flag risks and blind spots. (link)

How Credit Unions can run a 90-day AI readiness proof of value: Pick one workflow, connect knowledge + security guardrails, and pilot for 90 days, using decision gates before expanding into authenticated flows. Run pilots with 10-20% of self-service traffic. Aim for 30%+ containment, 90%+ grounded answers, ≤2% hallucinations, and 20% AHT cuts. (link)

GHS Federal Credit Union adopts Scienaptic AI for faster, more inclusive lending: GHS selected Scienaptic’s AI credit decisioning to speed approvals and move beyond single-score evaluations. (link)

How an internal “talent marketplace” can accelerate AI gains: At Standard Chartered, 60% of employees take short internal “gigs” that accelerate AI projects, creating $8.5M in value. Credit Union leaders can copy this by matching staff skills to AI pilots before hiring. (link)

Beware of AI-era security fraud risks caused by complacency: A PYMNTS report found companies lose an average 3.1% of annual revenue to identity verification failures, even as 96% believe their defenses are effective. “Good-enough” AI and bot controls can quietly increase fraud, onboarding drop-off, and trust erosion if not continuously tested and governed. (link)

Agentic AI will reshape banking across three tracks: More than 50% of financial institutions already use AI agents, but while banks see returns mainly in back-office efficiency (68%), only 32% get value from customer-facing AI. Meanwhile, fintechs embed agentic AI directly into products and customer journeys through full-service agents, adaptive experiences, and customer “agentic twins.” (link)

How to prepare for the risk of AI systems going offline at your bank: As AI runs fraud, AML, credit, and member service workflows, outages can halt approvals, stall fraud detection, or force compliance shutdowns. With 70% of large banks using chatbots, leaders should test whether “manual fallbacks” actually work at scale (link)

Bank of America uses AI copilots to make branches faster and lift digital sales: Erica Assist helps bankers find the right policy instantly, reducing mistakes and speeding service transactions. It also shares digital context across chat, phone, and branch to route customers to self-serve or an appointment, supporting a goal of 10M→30M appointments. (link)

CaixaBank’s new Artificial Intelligence Office will centralize oversight: The 100+ person team will oversee governance, operations, strategy, and culture across all AI use cases. (link)

CFOs say AI matters, but few are scaling it: In a survey of 5,000 global CFOs from Egon Zehnder, 44% rate AI “very important” to “critical,” yet less than 10% are scaling use cases due to data and talent gaps. 80%+ of AI use today sits in controllership (AP, AR, invoicing), with FP&A and treasury next. (link)

Funding Spotlight

Where the money is flowing for innovation…

xAI raises $20B Series E to scale AI infrastructure: Surpassing its $15B target, the funding will accelerate large-scale GPU infrastructure buildout and support continued development of Grok models, voice agents, and consumer and enterprise AI products. (link)

Pluto raises $8.6M seed round to use AI for lending against private assets: Pluto Financial Technologies is building AI-driven credit infrastructure that lets investors borrow against private equity and alternative assets using future fund distributions for repayment. (link)

Fireblocks acquires TRES Finance for $130M to bring CFO-grade controls to crypto assets: Fireblocks adds crypto accounting, reconciliation, and reporting by acquiring TRES Finance, giving CFOs visibility across wallets and platforms. (link)

Keeping up with Tech

The latest in fintech and tools…

Microsoft renames Microsoft 365 app to “Microsoft 365 Copilot”: Copilot integrates directly into Word, Excel, PowerPoint, and file workflows across web, mobile, and Windows. Office.com now redirects to m365.cloud.microsoft. (link)

OpenAI’s developer platform went agent-native in 2025: Reasoning-capable models, multimodal inputs (text, PDFs, images, audio, video), and new building blocks like the Responses API, Agents SDK, and Codex made it easier to run multi-step AI workflows in production. These changes make it more practical to deploy AI agents that read documents, use tools, manage state, and operate reliably inside real systems. (link)

In Other News

Related news you can learn from…

Morgan Stanley forecasts AI will displace 200,000+ European banking jobs by 2030 (link)

Most-read AI stories of 2025 show banks racing toward agentic AI (link)

Agentic AI handles end-to-end member requests beyond chatbots (link)

AI boosts creativity unevenly across teams using generative tools (link)

CFOs tie AI spend to decision speed (link)

Community Corner

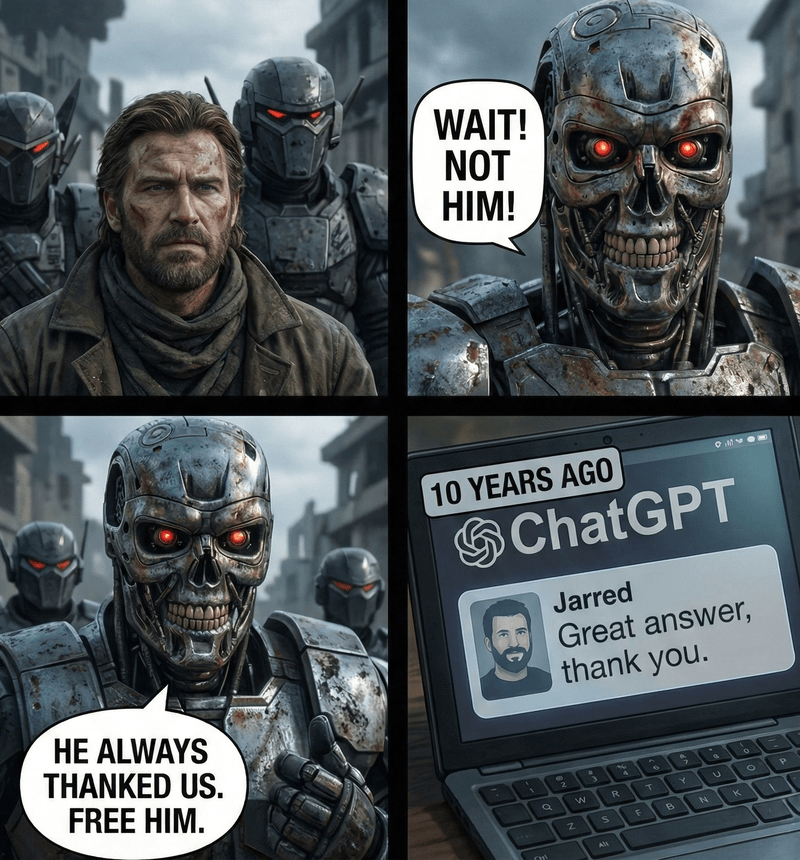

Memes and visuals…

Thanks for reading!

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!