CPM FCU drives 32% more accounts with AI onboarding | 12/18

Plus: Cornerstone’s AI playbook, $22M in new loans with AI underwriting, and more!

Can Credit Unions scale AI while staying compliant and member-first?

America’s Credit Unions is pushing regulators for balanced oversight, and this week's case studies show what works in practice.

If you’re new here, I find the hottest AI news for Credit Unions to bring you practical insights in a quick, digestible weekly newsletter.

Today, I cover:

CPM Federal Credit Union drives 32% more accounts opened with Cotribute

Cornerstone lays out a practical AI playbook for Credit Unions

Meridian Trust FCU books $22M in new loans using AI underwriting

Read time: 9 minutes

Top Stories

The biggest news this week…

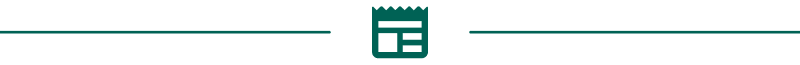

1) CPM Federal Credit Union drives 32% more accounts opened with Cotribute

Many Credit Unions lose would-be members before the relationship even starts, all due to a high-friction digital onboarding experience that feels like a branch process shoved onto a screen. On a recent CU 2.0 podcast with Kathy Richardson, VP of Digital Products and Services at CPM Federal Credit Union and Cotribute CEO Philip Paul, Richardson explained how their COVID-era setup was stalling online growth. So CPM FCU (about $650M in assets) partnered with Cotribute to redesign their digital onboarding flow.

Instead of duplicating branch steps, the platform automates identity checks, fraud signals, and decisioning automatically, while letting CPM’s own team configure flows, copy, and screens without filing IT tickets. Cotribute moved so quickly on integrations and baseline setup that CPM actually asked to slow down while internal vendor reviews caught up, a rare problem for any CU tech vendor.

The results followed fast: a 32% increase in new accounts in 90 days, an 82% reduction in manual reviews, and significant staff time freed from post-fraud cleanup. CPM tested the new flow through a soft launch in branches, where staff walked members through the experience while keeping a fallback to the old core process if anything broke. The flow works consistently across desktop and mobile, and identity verification uses a QR-code handoff to mobile via Plaid, drastically reducing “stuck” moments and contact-center calls. (link)

2) Cornerstone lays out a practical AI playbook for Credit Unions

Cornerstone Advisors released a detailed AI playbook aimed squarely at banks and Credit Unions that feel pressure to “do something with AI” but aren’t sure where to start. Instead of pitching enterprise-wide transformation, the playbook urges leaders to pick just 1-3 concrete AI use cases per business unit (finance, operations, lending, retail, digital, IT, or marketing). Then, deploy, iterate, and learn. The focus is on leveraging tools already in use today, including three types of AI: supervised and unsupervised machine learning, and robotic process automation.

Across roles, the examples are intentionally realistic. CFO teams are using AI for financial reporting, reconciliations, variance analysis, and early credit risk monitoring. Operations leaders are automating scorecards, quality control, data extraction, and internal documentation. Lending teams are applying AI to pipeline reporting, pricing, credit decisioning, and early-warning systems for default, while marketing and digital teams use AI for segmentation, personalization, chatbots, and retention. Throughout the playbook, Cornerstone repeatedly flags governance risks — emphasizing explainability, bias controls, and regulatory compliance as non-negotiables. (link)

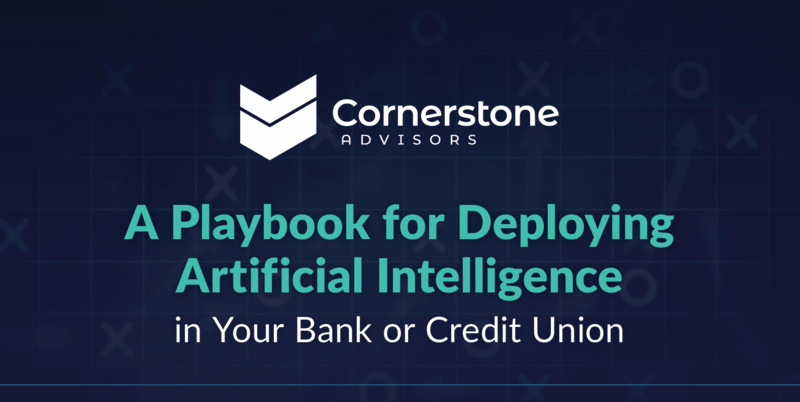

3) Meridian Trust FCU books $22M in new loans using AI underwriting

In a recent webinar, Meridian Trust Federal Credit Union shared how it embedded Scienaptic AI directly into the Sync1 loan origination system to modernize underwriting, especially for borrowers in the “messy middle” (like marginal and thin-file applicants). Instead of relying on variable human-only reviews, the setup pulls bureau data first, then taps core and alternative data only when needed, returning fast, consistent recommendations that underwriters can act on.

Meridian paired the AI rollout with operational changes like centralized underwriting, a migration to Sync1, and expanded access to deeper core insights to support better, faster decisions. The payoff showed up during a summer auto campaign, when the CU processed an additional 1,100 applications and booked $22M in new loans over roughly three months, while keeping human-in-the-loop decision turnaround under 30 minutes even before re-enabling full auto-decisioning.

Compliance was built into the foundation with explainable decisions, continuous fair-lending testing, and fully documented model parameters to keep the system audit-ready and reduce disparate-impact risk. (link)

Tips & Use Cases

Learn to apply AI…

We Florida Financial Credit Union automates 58% of calls with voice AI: Anticipating a surge in call volume, the CU deployed Interface.ai’s Voice AI to handle balance checks, transaction history, password resets, and card issues, replacing a limited IVR system. The rollout also reduced support staffing needs by 19% and maintains a 90-95% answer rate. (link)

Member Business Financial Services uses Microsoft Copilot to scale business lending without adding staff: The CUSO CEO Mark Ritter says only about 800 U.S. CUs do even minimal member business lending, a number that hasn’t moved in 10 years, with most growth concentrated among the top ~150 lenders. MBFS is “very deep” in Copilot as its entry point to AI, using it to speed up simple, repeatable back-office work so experienced lenders can focus on complex deals while keeping headcount flat. (link)

KEMBA Financial Credit Union grows deposits 37% by converting indirect auto borrowers into primary members: KEMBA used relationship-based pricing to encourage indirect auto loan borrowers to open checking accounts and deepen their relationship by offering better rates. After a 6-8 month rollout, the CU also reported ~40% higher checking penetration and ~15% more engaged members in its indirect program. (link)

Red Rocks Credit Union debuts voice AI assistant: “Roxie,” powered by Interface.ai, delivers 24/7 phone-based support for routine requests like balance checks, transaction history, and branch information using secure multifactor authentication. Red Rocks expects the AI to handle more than half of routine inquiries by year-end. (link)

Speed, not size, is becoming banking’s AI advantage: PwC reports that 58% of banking leaders see generative and agentic AI as the most transformative force over the next three years, and 55% already rank it as their top investment priority. At the same time, 90% say they lack the capabilities needed for tomorrow, while only 25% prioritize workforce reinvention. (link)

Credit Unions keep digital banking knowledge in-house more than banks: Survey data shows 63% of CUs say internal staff manages most digital banking platform details with provider support, compared with 55% of banks. Meanwhile, banks are nearly twice as likely to rely primarily on providers (41% vs. 22%). (link)

Use AI as a strategic advisor with the PCACI method: Securityplus Federal Credit Union CIO Ray Ragan says executives can use tools like ChatGPT, Gemini, and Claude as strategic consultants by structuring prompts around Persona, Context, Ask, Constraints, and Interviews (PCACI). This helps leaders pressure-test strategic plans, model scenarios, and identify gaps in talent and execution. (link)

AI-driven document intelligence cuts underwriting from weeks to hours: Purpose-built lending AI replaces manual PDF review by instantly classifying, extracting, and validating data across bank statements, tax forms, SBA documents, appraisals, and contracts. Platforms like Uptiq go beyond OCR by flagging missing documents, inconsistencies, and fraud signals. (link)

Finance roles are shifting from reporting to AI-assisted judgement: Institutions like JPMorgan (with 700+ AI-related roles) and Morgan Stanley are restructuring finance teams around AI leverage, while manual, spreadsheet-heavy work continues to disappear as AI handles reconciliation, forecasting, and summarization faster and more reliably. The emerging role for finance leaders is translating AI outputs into clear decisions and narratives. (link)

Agentic AI makes banking more human by removing service friction: Agentic AI can resolve routine requests end-to-end, understand context, and escalate to humans at the right moment, eliminating the tradeoff between automation and empathy. For example, at Navigator Credit Union, Interface.ai’s Voice AI now handles common inquiries so staff can focus on fraud, lending, and high-touch conversations. (link)

Gemini 3 Pro uncovers $30K in hidden vendor savings: Wouter Born explains how he used Gemini 3 Pro to spot duplicate vendor records (like multiple “AWS” entries) that fragment spend totals. The workflow pairs an LLM-powered interface with deterministic fuzzy matching inside a private app that keeps sensitive finance data in-house. (link)

Experian’s Molly Poppie explains why AI in finance lives or dies by data quality: AI’s impact in lending depends less on advanced models and more on fresh, complete data like cash flow, income, and BNPL signals. 95% of financial institutions report rising model risk management scrutiny, while 60% still rely on manual processes that consume up to 30% of staff time. (link)

OceanFirst Bank cuts AML and portfolio analysis time with Microsoft Copilot: OceanFirst has onboarded 150 employees to Microsoft Copilot, using it to speed up anti-money-laundering investigations and investment analysis after a major data cleanup effort. AML reviews that once took 6-8 hours can now be done in minutes, while bond portfolio analysis has dropped to about 15 minutes. (link)

CFOs use AI for core finance tasks but keep humans in control of big decisions: A PYMNTS Intelligence survey found all CFOs (60 surveyed) at $1B+ companies now use AI for at least one finance function, with nearly half applying it to continuous cash-flow tracking and many using it for audit readiness and data governance. But only 22% use AI for cross-system workflows, showing CFOs still want a human hand on the wheel. (link)

JPMorgan Chase outlines its push to become an AI-connected enterprise: JPMorgan is rolling out an internal “LLM Suite” that connects models from OpenAI and Anthropic to its proprietary data, already delivering productivity gains like generating investment banking decks in seconds. But fully integrating AI across thousands of systems will still take years, even with an $18B annual tech budget.(link)

AI is no longer optional for Credit Unions: LaMacchia Group says AI has become a competitive necessity for Credit Unions, driving gains in member service, fraud prevention, and lending. The firm points to near-term use cases such as conversational AI and AI-assisted underwriting, supported by robust data governance. (link)

How AI could make Credit Unions the unexpected winners: AI removes the tradeoff between efficiency and member experience by automating routine work and freeing staff to focus on high-value member interactions. This gives CUs a realistic way to compete with fintechs and big banks while leaning into their community and human advantage. (link)

AI fatigue is pushing customers back toward human-centered institutions: Only 17% of U.S. households say they’re very comfortable with AI-driven banking. Community banks and Credit Unions are gaining ground by using digital tools to reduce friction and focusing on empathy, continuity, and local understanding. (link)

How Lloyds Banking Group AI is reshaping traditional banking from the inside: Lloyds is using generative AI to search unstructured data across chats, calls, and documents, with a knowledge chatbot now used by 11,000 employees supporting 28 million customer calls a year. The biggest bottlenecks are data quality and building flexible architecture with agentic AI and humans-in-the-loop. (link)

Beware of AI prioritizing consensus over original insights: Most organizations use AI to double down on what already worked, helping everyone reach the same “safe” conclusions faster instead of uncovering new opportunities. The real advantage comes from using AI to flag what looks different or risky, then relying on human judgment to decide what truly matters. (link)

5 unavoidable tensions leaders face as AI enters the workplace: AI adoption is a balancing act among 1) experts vs. novices, 2) centralized vs. decentralized control, 3) flatter vs. taller organizational structures, 4) moving fast vs. protecting slow, thoughtful work, and 5) top-down change vs. peer-driven adoption. (link)

BBVA expands ChatGPT Enterprise to 120,000 employees with OpenAI partnership: BBVA is rolling out ChatGPT Enterprise across its workforce after pilots showed over 80% daily usage and nearly three hours saved per employee per week. The bank plans to use the platform for internal productivity, software development, risk analysis, and personalized banking under enterprise security and governance controls. (link)

Capital One, Bank of America, and JPMorgan Chase account for 75% of banking AI patents: New data from Evident shows these three big banks account for roughly 75% of banking AI patents since 2023, with heavy focus on GenAI, customer service, and early agentic systems. (link)

Banking futurist warns banks have 5 years to prepare for agentic AI: Brett King says AI agents will soon handle discovery, product matching, funding, and payments in seconds, with humans overseeing higher-risk decisions. He argues banks must rebuild data foundations, break internal silos, and redesign workflows now or risk falling behind as AI-to-AI financial interactions become standard. (link)

Funding Spotlight

Where the money is flowing for innovation…

Informed.IQ lands $63M growth equity round to scale AI loan verification: The funding backs expansion of its agentic platform, which verifies income, assets, residence, insurance, and identity using more than 2 billion data points from 100+ million loan documents. The system already supports over $350B in originations for 7 of the top 10 U.S. auto lenders. (link)

AIR raises $6.1M seed round to build real-time AI credit ratings: The company is developing an autonomous system that continuously assesses the financial health of public and private companies using decades of financial and alternative data. Early customers include institutions managing more than $4T in assets that rely on up-to-date risk signals. (link)

Safebooks AI raises $15M seed round to automate revenue data integrity: The platform overlays existing CRM, ERP, and billing systems to continuously monitor, validate, and reconcile revenue data in real time. It already tracks more than $40B in transactions and has eliminated thousands of hours of manual reconciliation for finance teams. (link)

Saviynt closes $700M Series B to expand AI-era identity security: The round supports expansion of a unified identity platform that governs access for human users, machine identities, and AI agents across applications, data, and infrastructure. Saviynt now serves more than 600 enterprise customers, including over 20% of the Fortune 100, and plans to accelerate R&D, deepen integrations, and support customer migrations from legacy systems. (link)

DeepWorq AI raises a pre-seed round to build modular finance automation: The company is developing AI modules that handle invoicing, payment reminders, tax reporting, and financial document analysis, while adapting to regulatory and business contexts in real time. The funding will support compliance research and production deployments that replace labor-intensive back-office workflows without ripping out existing systems. (link)

Keeping up with Tech

The latest in fintech and tools…

GPT-5.2 underperforms vs. GPT-5.1 on finance agent benchmarks: Most AI models are around coin-flip reliability, with GPT-5.1 currently leading at 56.55% accuracy. GPT-5.2 (52.79%) scores lower than GPT-5.1 on the same benchmark despite running at ~2x the cost. Finance teams still need to rely more on workflow design, tool use, validation layers, and governance. (link)

Posh AI introduces agentic Operating Procedures for governed banking automation: The AI vendor launched a governance and reasoning layer that lets AI carry out real banking workflows like payments, resets, and account actions while enforcing compliance and policy guardrails. By defining outcomes and rules, the system enables agentic execution that stays auditable and controlled inside regulated environments. (link)

Klarna launches open protocol to make products usable by AI agents: Klarna introduced an API standard that gives AI agents a structured, real-time view of product and pricing data across markets, enabling discovery, comparison, and recommendations at scale. The protocol works with existing merchant feeds like Google Merchant, Shopify, and Facebook Catalog. (link)

Axyon AI debuts agentic platform for thematic investing research: Axyon Foresight is a human-in-the-loop system that scans thousands of stocks to construct thematic investment universes in hours using transparent, auditable scoring. (link)

Stripe rolls out agentic commerce tools for AI-driven sales: The Agentic Commerce Suite is a low-code platform that enables businesses to sell through multiple AI agents via a single integration. The setup helps merchants accept agent-driven transactions without rebuilding checkout or payments infrastructure. (link)

BridgeWise releases AI for corporate bond analytics: FixedWise delivers standardized, bond-level insights across global corporate debt using proprietary micro language models. The system translates complex fixed-income data into clear, regulation-aligned analysis of risk, yield, duration, maturity, and ratings for retail and institutional users. (link)

47% plan to use AI agents for Christmas shopping: New Checkout.com research shows nearly half of shoppers expect to use AI agents for Christmas 2025, mainly for gift discovery, price comparison, and routine purchases, with younger shoppers leading adoption. (link)

ChatGPT now offers more precise image generation and editing: The new image model generates visuals up to 4x faster and supports controlled edits that preserve lighting, composition, and key details. (link)

GPT-5.2 arrives as OpenAI’s most capable model for knowledge work: OpenAI says GPT-5.2 sets a new bar for long-running, multi-step knowledge work, outperforming or matching human professionals on more than 70% of tasks across 44 occupations. (link)

Microsoft 365 Copilot rolls out GPT-5.2 for enterprise workflows: Now available in Microsoft 365 Copilot and Copilot Studio, GPT-5.2 Thinking assists with complex reasoning, while GPT-5.2 Instant supports everyday tasks. Integrated with Work IQ, it lets teams reason across emails, meetings, documents, and chats to support more secure, enterprise-grade AI workflows. (link)

Microsoft makes GPT-5.2 available in Foundry: The latest ChatGPT model is now available inside Microsoft Foundry with governance controls, managed identities, and policy enforcement designed for compliance-heavy environments. (link)

Gemini Deep Research adds visual, interactive reports: Google enhanced its research mode to generate reports with charts, images, and interactive simulations that let users explore scenarios and adjust variables in real time. (link)

OpenAI reflects on a decade of progress toward AGI: 10 years ago, OpenAI was born from 15 “nerds” trying to figure out how to progress AI. Over the decade, it grew from early AI experiments and key research wins into launching tools like ChatGPT and GPT-4, which brought AI into everyday use around the world. (link)

In Other News

Related news you can learn from…

House Financial Services Committee considers AI sandbox to let financial firms test new tools (link)

America’s Credit Unions urges for flexible AI regulation to protect consumers & innovation (link)

Bank of America warns of an “AI air pocket” as it trims S&P 500 outlook for 2026 (link)

Executive order seeks to prevent state AI laws and centralize oversight (link)

“Frontier Firms” show how leaders unlock real business value from AI (link)

Regulators need to give banks clearer rules for adopting AI (link)

AI is reshaping what “fair hiring” actually means (link)

Community Corner

Memes and visuals…

Thanks for reading!

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!