GenAI adoption surges faster than any previous lending tech | 12/4

Plus: AI copilots reshape how people manage money, bank jobs fall to 2019 lows, and more!

Black Friday online spending hit a record $11.8B last week, driven by an 805% surge in AI-powered shopping traffic.

If you thought AI-powered commerce was still “emerging,” Black Friday just proved it’s already here.

First time reader? I find the hottest AI news for Credit Unions to bring you practical insights in a quick, digestible newsletter every week.

GenAI adoption surges faster than any previous lending technology

Experian bets big on AI-powered financial guidance

Bank jobs fall to 2019 lows as AI reshapes staffing

Read time: 8 minutes

Top Stories

The biggest news this week…

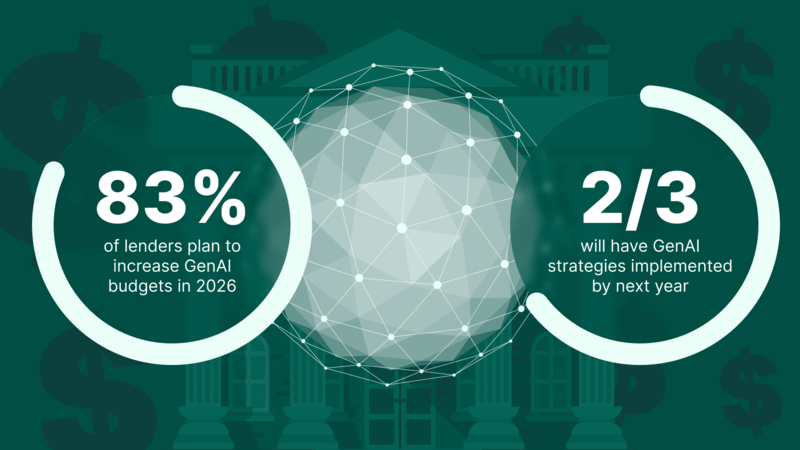

1) GenAI adoption surges faster than any previous lending technology

A new Celent + Zest AI survey of 106 lenders (including Credit Unions) shows the industry is adopting GenAI faster than any prior lending technology. But are security, risk, and compliance maturity keeping pace? With 83% increasing GenAI budgets in 2026 and 67% already implementing strategies, the pressure to compete on efficiency and experience is pushing institutions from pilots into production before guardrails are fully built.

Consumer lending teams are accelerating the fastest: only 6% have a GenAI strategy today, but 36% will develop one in 2025, closing the gap with broader retail banking, where 32% plan to implement GenAI in 2025. What’s slowing most institutions down: 19% cite security as the top barrier, 20% rank it second, and 15% mention competing priorities as the next biggest obstacle. Agentic AI is also rising fast, creating new governance challenges as 8% already use it, and 28% plan to.

As adoption spreads across copilots, compliance automation, and BI dashboards, the risk of ungoverned model drift and regulatory exposure grows. Yet, the report frames GenAI as a major competitive opportunity, with 36% of lenders identifying as early adopters. Respondents pointed to three areas where GenAI delivers the strongest edge: AI copilots that assist loan staff in navigating policies and documents, automated compliance and regulatory reporting that surfaces potential violations, and advanced business intelligence powered by AI-driven analytics. (link)

2) Experian bets big on AI-powered financial guidance

At Money20/20, Experian Consumer Services President Daisy Yee outlined how the company is shifting from a credit score tool to a full financial copilot — powered heavily by AI and hyper-personalization. With inflation and financial stress rising, Yee said consumers are increasingly turning to AI assistants for non-judgmental, real-time help managing bills, credit, budgeting, and financial decisions.

Experian’s virtual assistant, Eva, now supports natural-language conversations and can take actions on behalf of users, including freezing credit files, monitoring insurance rates, negotiating bills, and cancelling subscriptions. Yee said consumers are surprisingly more willing to disclose sensitive financial issues to AI than to people, enabling Experian to deliver personalized guidance built from transaction history, spending patterns, and credit data. The company’s long-term strategy is evolving from credit monitoring to a lifelong financial companion, reinforced by its new “BFF: Big Financial Friend” campaign. (link)

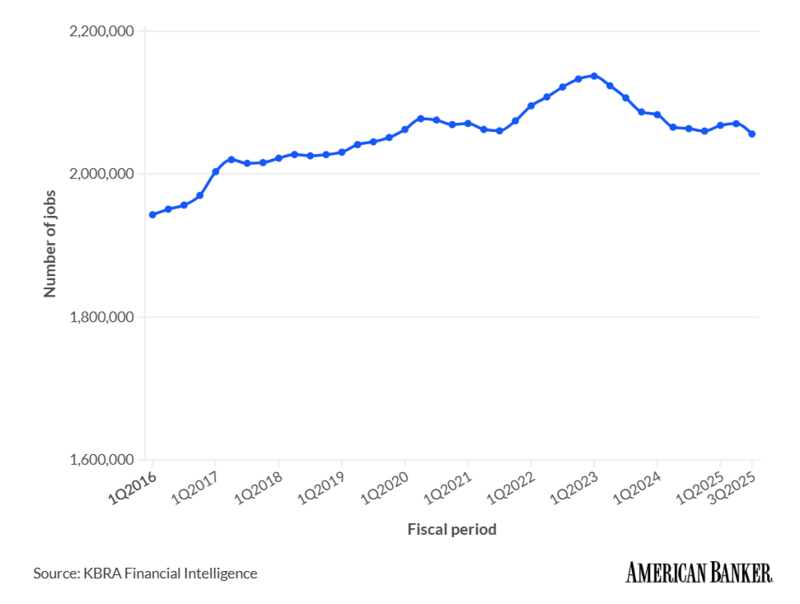

3) Bank jobs fall to 2019 lows as AI reshapes staffing

U.S. banks have eliminated nearly 81,000 jobs since early 2023, dropping the industry workforce to its lowest level since 2019. A Bureau of Labor Statistics subcategory covering banks and Credit Unions shows a YoY decline of roughly 2,900 jobs. Analysts say AI is a central driver of these cuts, which may be permanent.

The trend is largely driven by banks with $250B+ in assets, reducing full-time staff by 0.8% YoY. Meanwhile, banks with less than $250B in assets saw a slight 0.2% gain in jobs. Citi, Wells Fargo, and BNY Mellon account for the bulk of reductions, each tying workforce changes to AI-driven productivity gains. Citi is rolling out agentic AI to 5,000 employees to automate multistep workflows, while BNY Mellon has already deployed more than 100 digital workers handling payment validations and code repairs.

With interest-rate pressure compressing margins, banks are leaning on tech to remove redundancy rather than wait for economic relief. (link)

Tips & Use Cases

Learn to apply AI…

5 types of GenAI friction Credit Unions must overcome for implementation: A new MIT analysis shows 95% of GenAI projects fail due to organizational friction that slows and misdirects progress. CUs should treat friction as a signal that reveals misaligned goals, scattered data, cultural misalignment, unclear workflows, or governance risks. (link)

Younger members are primed for AI adoption if you earn their trust first: With 70% of Gen X through Gen Z using AI weekly but only 6% relying on it for financial planning, Credit Unions should lean into hyper-personalized insights and guidance. Use AI to deliver real-time financial wellness insights across mobile, email, and SMS to deepen relationships while building the trust needed for future, higher-stakes AI interactions. (link)

Ben Udell from Marquis shares 10 prompts that reduce AI “workslop” in bank marketing: Marketing teams often use GenAI as a content factory, producing polished but generic messaging that weakens trust. These prompts refine tone and strengthen clarity, turning GenAI into an editing partner that helps Credit Unions create more authentic, mission-aligned communication. (link)

Citizens scales 3 high-impact AI use cases: AI-assisted development now supports 800 engineers, delivering a 10-15% productivity lift as genAI rewrites legacy code and accelerates modernization. In member service, the CiZi virtual assistant has reduced calls from the mobile app by 44%, while agentic AI pilots are automating 100% of call-quality reviews and speeding up complaint handling. (link)

BCG outlines leadership playbook for measurable AI transformation: BCG finds only 5% of banks capture AI value at scale, achieving 5x revenue gains and 3x cost reductions compared to laggards. Winners set bold, yet quantifiable targets, rebuild end-to-end workflows, and invest in strong data foundations and reskilling programs that reach 40-50% of employees. (link)

AI disruption forces lenders to rebuild SEO acquisition from scratch: Google’s Helpful Content Update and AI Overviews have erased 50-90% of organic traffic, creating a zero-click environment where LLMs answer questions and drive lenders into costly paid search auctions. Credit Unions should pivot to brand, creator, and owned-audience strategies while optimizing for Generative Engine Optimization so their products and expertise surface inside AI answers. (link)

7 tips for generating pro images and designs with Google’s new Nano Banana Pro: 1) Use detailed prompts that specify subject, composition, action, location, style, and editing instructions. 2) Add advanced camera, lighting, aspect-ratio, and text constraints for sharper outputs. 3) Blend or resize images to maintain character consistency and brand styling across formats. Plus, four more tips for your marketing team! (link)

Santander’s AI ads raise awareness of AI fraud: Santander U.K.’s deepfake ads found that 74% of consumers failed to spot an AI-generated padel bat and 71% missed a deepfake dog feeder scam. The bank reported £16.7M in losses from purchase fraud last year, with 67% originating on social media. (link)

How agentic AI moves banking from self-service to self-resolution: Unlike traditional IVR, apps, or chatbots that give information but leave the work to members, agentic AI interprets intent, authenticates users, reasons across accounts, and completes tasks end-to-end. (link)

3 non-negotiables for safe AI in banking: With AI risk-assessment models still yielding a 15% error margin, financial institutions need compliance-first automation with clear audit trails, explainable AI decisions, and strong governance controls. (link)

“Finance-grade AI” needs to be held to a high standard: Maxa co-founder Raphael Steinman warns that most finance AI projects fail because leaders deploy generative tools atop fragmented, error-prone data, producing unreliable insights. “Finance-grade AI” must fully explain its answers instead of spitting out a probable answer that, even if just 1% wrong, could cause errors costing millions of dollars. (link)

SMB credit personalization is a Credit Union growth opportunity: 83% of SMBs feel confident they’d be approved for a business card, and the average SMB is willing to pay $126/year more for flexible tools like dynamic limits, virtual cards, and installment options. (link)

HSBC adopts self-hosted Mistral AI models for bank-wide automation: HSBC signed a multi-year agreement to deploy Mistral’s foundational models on its own infrastructure, starting with productivity tools for marketing, document analysis, translation, and software development. The bank plans to expand the initiative into credit, onboarding, fraud, and anti-money laundering. (link)

CBA appoints Chief AI Officer to scale enterprise-wide AI adoption: Commonwealth Bank of Australia hired Lloyds’ Chief Data Officer, Ranil Boteju, to lead its AI strategy after he delivered 50+ GenAI initiatives and improved Lloyds’ Evident AI Index ranking. The bank is embedding AI into fraud prevention, loan decisioning, and credit reviews, supported by its AWS-powered “AI Factory” and a multi-year deal with ChatGPT Enterprise. (link)

2026 predictions for AI in banking: Banks will shift from pilots to large-scale AI agents that automate end-to-end workflows, deliver hyper-personalized service, and power embedded finance ecosystems through real-time data. Thin, modular cores, human-in-the-loop governance, and unified data will enable AI agents to safely scale across onboarding, lending, fraud, and operations. (link)

BIS shows AI can safely automate complex financial decision-making: A BIS study found that a ChatGPT-based agent could prioritize payments, manage cash buffers, and minimize delays in simulated stress scenarios — demonstrating AI’s ability to handle complex financial workflows with little guidance. (link)

What IT leaders should know about SOC vs PCI security for Credit Union vendors: SOC 2 verifies that a vendor follows its own policies, but PCI DSS Level 1 enforces prescriptive controls like segmentation, encryption, and continuous scanning, making it the only standard that protects payment data in real time. (link)

Funding Spotlight

Where the money is flowing for innovation…

AI wealth-management startup Nevis lands $35M Series A to scale advisor automation: Backed by Sequoia, Iconiq, and Ribbit, Nevis is building an AI platform that completes operational tasks for financial advisors end-to-end and is already used by fast-growing Registered Investment Advisors overseeing more than $50B in assets. (link)

Codenotary raises $16.5M to grow its AI-driven software-trust platform: The company’s deterministic, audit-ready tech replaces manual software verification with automated integrity checks and continuous policy enforcement across complex systems. (link)

Vijil secures $17M to make agentic AI safer for enterprise use: The AI-resilience platform uses real-world telemetry and reinforcement learning to harden agentic systems against failures, security risks, and compliance gaps. Early customers report a 75% reduction in “time-to-trust.” (link)

Clover raises $36M to prevent security flaws at the design stage: Clover’s AI agents plug into Jira, GitHub, Confluence, and Slack to detect vulnerabilities during product design, mimicking senior security engineers to guide developers in real time. (link)

BKN301 adds £10M credit facility and acquires AI fintech Planky: The acquisition brings Planky’s real-time financial insights, behavioral scoring, and predictive analytics engine into BKN301’s digital banking stack, strengthening its payments, wallets, card issuing, and open banking capabilities. (link)

Keeping up with Tech

The latest in fintech and tools…

Disseqt AI, HCLTech, and Microsoft partner to guide banks on agentic AI adoption: The collaboration combines Disseqt’s lean agentic-automation platform with HCLTech’s banking expertise and Microsoft’s Responsible AI frameworks to help institutions deploy agentic systems with proper oversight. At a recent Dublin roundtable, leaders noted that only 1% of organizations have adequate governance in place and showed how Disseqt can cut costs up to 80%, shorten production cycles by 70%, and strengthen testing and monitoring. (link)

HCLTech and AWS team up to push autonomous, AI-driven financial services: HCLTech will launch pre-built, industry-compliant solutions on AWS to modernize contact centers, enhance digital engagement, and streamline core banking, wealth, and insurance platforms. The collaboration aims to help financial institutions overcome legacy constraints and move toward autonomous operations using cloud and AI. (link)

PayPal doubles down on agentic AI and wallets as its new competitive strategy: PayPal is shifting to an AI-first commerce model, rolling out agentic checkout with Perplexity and OpenAI, adding product-search and autonomous purchase capabilities, and partnering with Mastercard and Google Gemini for agent-driven payments. (link)

AI-native systems are becoming the new operating model for modern organizations: Startups are rebuilding their internal systems around AI, using structured context, agent-driven workflows, and fine-tuned models to boost velocity and automate complex operational tasks end to end. (link)

AI agents get direct payment rails through Omise’s new MCP server: Omise’s MCP server lets AI agents tap into 60+ payment tools to autonomously run acceptance, refunds, reconciliation, payouts, and full payment-lifecycle operations without custom integrations. The platform provides financial-grade, two-way orchestration so agents can execute complex payment tasks reliably in production environments. (link)

Microsoft earns Leader position in Gartner’s Cloud ERP Finance ranking: Dynamics 365 Finance was recognized for its global financial capabilities, embedded AI automation, and Copilot Studio, which lets teams build finance-focused AI agents using natural language. The platform combines multi-entity support, predictive analytics, and low-code automation. (link)

Ant International adds agentic automation across the full merchant payment lifecycle: The merchant payment services provider upgraded its Antom Copilot system to automate onboarding, integration, risk checks, disputes, and payment-success operations using agentic workflows, multi-turn reasoning, and dynamic SOP planning. The platform has already cut integration time by 90% and improved dispute-handling efficiency by 46%, providing proactive, domain-trained operational intelligence for merchants. (link)

In Other News

Related news you can learn from…

AI solves 30-year math problem (link)

Emerging tech Credit Unions are buying (link)

The top 5 AI fintech developments in November (link)

Agentic commerce is exploding, but guardrails lag behind (link)

Former OpenAI Chief Scientist claims AI’s “age of scaling” is coming to a close (link)

Research warns that offloading thinking to AI weakens neural engagement in professionals (link)

Community Corner

Memes and visuals…

Thanks for reading!

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!