How American Eagle FCU uses AI to power financial wellness | 1/15

Plus: the state of fintech in 2026, UKFCU’s playbook for AI governance and exams, and more!

The real AI risk lies in inaction as fintechs move to directly compete with financial institutions.

This week’s stories show how Credit Unions are fighting back, using data, governance, and practical AI to protect member relationships.

Today, I cover:

How American Eagle FCU uses AI to power financial wellness

State of Fintech 2026 hits an inflection point

UKFCU’s playbook for AI governance and exams

Read time: 8 minutes

Top Stories

The biggest news this week…

1) How American Eagle FCU uses AI to power financial wellness

Many Credit Unions want to improve financial wellness but struggle to move beyond generic education tools and one-size-fits-all digital experiences. At American Eagle Financial Credit Union, that challenge was amplified by a five-person digital team that owns everything from online account opening and bill pay to fraud mitigation and frontline support. As SVP of Digital Services, Pamela Villanova explained on the FIsionaries podcast, the Credit Union isn’t just competing with other financial institutions anymore — it’s competing with the digital experiences members get from Amazon and Uber.

Their playbook was to get specific before buying tech. Villanova said American Eagle started with a deep digital assessment to define its “north star” before shopping for vendors. The team aligned on three priorities: improving user experience, gaining better access to member data, and turning that data into timely, relevant outreach. Those requirements led American Eagle to Alkami, which gave the Credit Union more control over personalization, campaign setup, and gradual rollouts without relying on vendor tickets. Mari Gadlin, Director of Digital Banking Services, said that shift alone made the team more nimble and reduced internal friction around change.

On the financial wellness side, American Eagle focused on behavior change rather than just education. The Credit Union uses a FinHealth survey to help members self-assess, runs targeted wellness outreach, and is moving SavvyMoney into Alkami because it helps members understand their finances in plain language. Early validation came from feedback loops. Member-facing teams shared real-world input, and a digital-banking-specific CSAT survey delivered a high response rate, confirming the same gaps leadership had already identified. (link)

2) State of Fintech 2026 hits an inflection point

The State of Fintech 2026 report from fintech analyst Simon Taylor argues the industry has crossed a structural threshold. Fintech is no longer “challenging” banks. It’s operating at bank-level scale. Taylor points to hyperscalers like Nubank, Revolut, and Robinhood, which now serve tens or hundreds of millions of users globally. Nubank grew from 110M to 127M customers, Revolut from 50M to 64M, and Robinhood has nearly doubled assets under custody, putting these firms firmly on the same axis as traditional banks.

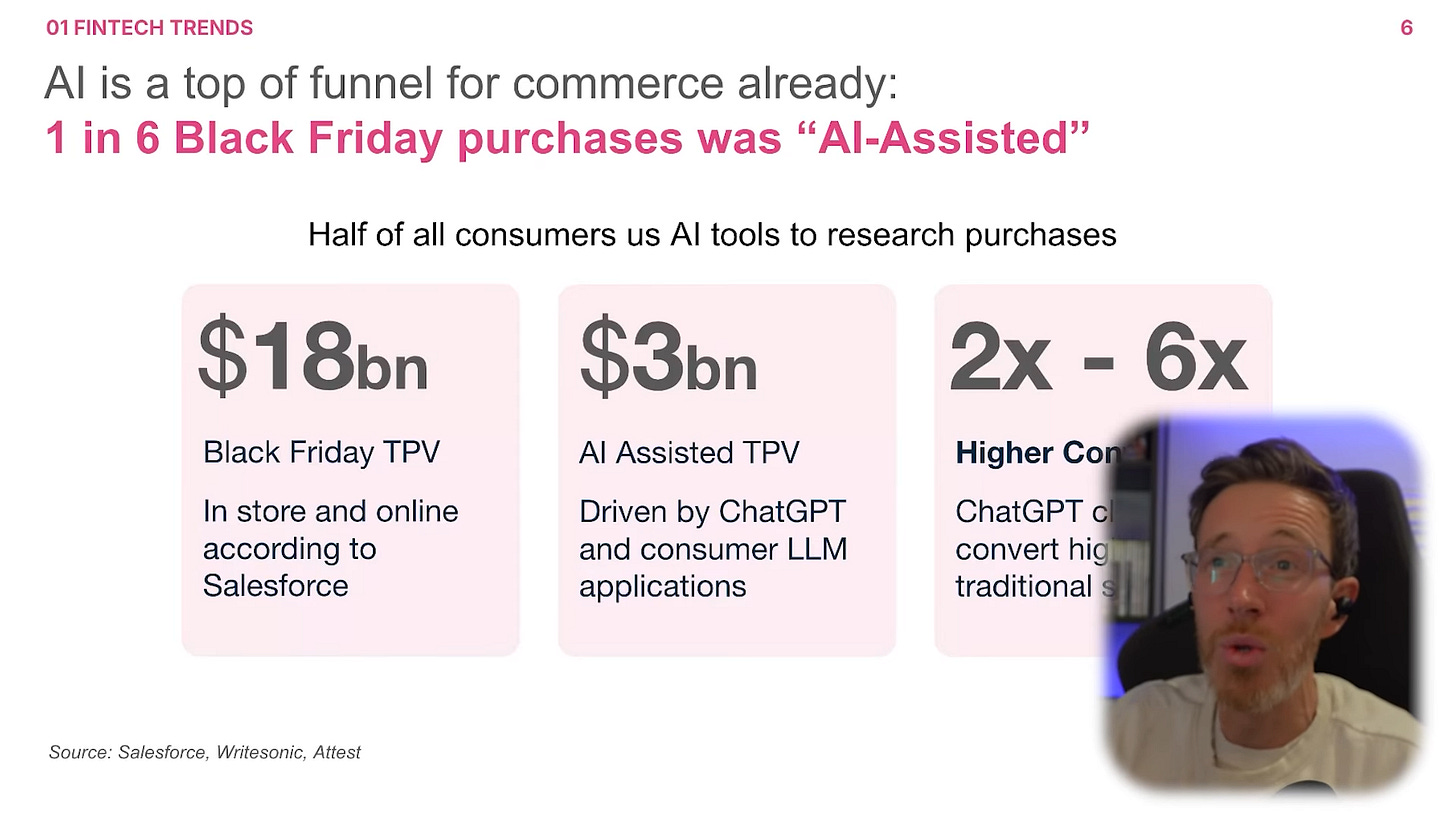

AI is the second force driving the shift, and it’s already reshaping consumer behavior. Taylor cites data showing one in six Black Friday purchases was AI-assisted, and roughly 50% of consumers now use AI tools to research purchases before buying. That positions large language models as a new “pre-purchase decision engine,” potentially rivaling traditional search and ads.

The third inflection point is infrastructure. Stablecoin supply has surpassed $350B, with growth decoupling from crypto prices, signaling real payment utility rather than speculation. Most volume is coming from B2B payments, treasury, and card-linked use cases. At the same time, AI-driven “agentic commerce” is pushing payments into a fragmented, early-stage protocol war, as card networks, stablecoins, and new AI-native rails all compete to power automated transactions. (link)

3) University of Kentucky FCU’s playbook for AI governance and exams

Most Credit Unions still treat cybersecurity exams like a fire drill: you get the request list, everyone drops their day jobs, and the “evidence scramble” begins. Mike Sloan, AVP of Information Security at University of Kentucky Federal Credit Union, said UKFCU broke that pattern by moving to continuous compliance in late 2024, collecting artifacts throughout the year instead of racing at exam time. The payoff showed up in the 2025 exam. UKFCU delivered what examiners asked for, heard very little follow-up, and Sloan estimated the new approach saved ~12 hours across teams while keeping other departments from having to “drop what they’re working on” to chase documentation.

UKFCU applied the same mindset to AI: assume it’s not going away, and govern it before you scale it. Sloan said the Credit Union started with acceptable-use policies, then built employee training with its L&D team to make expectations operational (not just legal language). From there, UKFCU moved into monitoring and enforcement using Microsoft Purview, which tracks who is using AI tools and blocks or allows tools based on a defined risk score. Anything below an “8” risk score is unsanctioned and blocked. But tools above that are allowed as the team matures, with controls around which data is used in prompts.

Heading into 2026, UKFCU’s next step is to use AI to standardize and streamline vendor reviews, while strengthening SLAs and notification expectations so incident-response obligations are clear when something breaks. (link)

Tips & Use Cases

Learn to apply AI…

SELCO Community Credit Union modernizes internal knowledge with AI Knowledge Hub: SELCO is rolling out eGain’s AI Knowledge Hub and AI Agent to replace SharePoint with a single, governed source of truth for ~500 employees across branches, lending, and operations. The platform embeds directly into the Genesys agent desktop, improving onboarding, compliance visibility, and day-to-day decision support. (link)

IgniteFI outlines how AI helps Credit Unions compete with fintechs: AI is pushing Credit Unions beyond small pilots toward focused use cases tied to real member and operational needs, with success depending on strong governance and aligned fintech partners. CUSOs and consortium models enable smaller CUs to share AI capabilities, reduce risk, and free staff to focus on high-touch member service. (link)

How AI turns payments data into proactive member guidance: On Fintech Unleashed, Virginia Heyburn and Dr. Art Harper of Engage fi describe how AI drives real-time “next best offer” prompts, dynamic credit limits, and personalized rewards using a full, relationship-level view of the member. The same decisioning supports smarter fraud prevention, financial literacy journeys, and life-stage product recommendations powered by CRM systems. (link)

How CRM + AI turns member data into real-time action: AI transforms CRM from a static system of record into a system of action by cleaning data, surfacing next-best actions, and automating workflows across marketing, lending, and service. Institutions using AI-powered CRM ecosystems are already handling more volume with the same staff while improving approval speed, operating efficiency, and member satisfaction. (link)

Fraud and AI are now inseparable in financial services: New data from American Banker shows 53% of financial institutions rank AI and machine learning among their top five tech spending priorities for 2026, while 53% also prioritize enhanced security and fraud mitigation. Real-time payments fraud is expected to have the biggest negative impact on organizations this year. (link)

Why AI, crypto, and fraud are colliding faster than most institutions expect: Ron Shevlin and Stacy Bryant of Cornerstone Advisors describe AI, crypto, and fraud as the three biggest unknowns shaping 2026, with AI accelerating new fraud types when combined with tokenization and real-time payments. They caution that agentic AI isn’t ready for prime time due to data silos, pointing instead to coordination layers like MCP as the real unlock for real-time, AI-driven engagement. (link)

Why generic AI creates compliance risk, but regulated AI avoids it: General-purpose LLMs pose real regulatory risk by drifting into unauthorized financial advice, creating exposure around NCUA, TILA, and FFIEC rules. Meanwhile, interface.ai’s BankGPT platform uses NCUA-trained models, real-time compliance monitoring, and automated guardrails to deliver accurate, auditable responses. (link)

AI success depends on rebuilding banking architecture: AI will only deliver real advantage for banks and Credit Unions built on genuinely new, multi-cloud, intelligence-first architectures, not containerized legacy systems or workflow automation. Agentic banking, AI-native competitors, and new digital-asset business models will separate institutions that redesign from the foundation from those optimizing yesterday’s systems. (link)

SMBC Americas plans to use AI for scaling compliance and onboarding: SMBC Americas is deploying Fenergo’s AI platform to automate KYC, AML, and client lifecycle management, reducing manual reviews and accelerating onboarding as part of a multi-year transformation. (link)

What “AI loan approval” really means inside modern lending teams: Most AI loan approval systems combine rules-based checks, machine learning risk models, and AI agents that orchestrate document processing, fraud detection, and human escalation, rather than replacing underwriters outright. Platforms like Multimodal’s AgentFlow coordinate OCR, credit risk models, confidence thresholds, audit logging, and human-in-the-loop reviews to deliver faster, explainable, and regulator-ready loan decisions. (link)

How agentic AI helps Credit Unions boost member growth in 2026: Early deployments of Multimodal’s AgentFlow show up to a 17% lift in cross-sell conversions and a 12% reduction in churn by turning data, documents, and decisions into coordinated member journeys. As younger members flock to fintechs offering instant onboarding and cash incentives, agentic AI platforms enable CUs to automate digital account opening, deliver real-time funding offers, and personalize engagement at scale with full auditability. (link)

How AI reduces CRE risk without loosening credit standards: In commercial real estate lending, AI is improving visibility into gray-area deals and portfolio risk rather than replacing underwriter judgment. One regional bank using Blooma, a CRE intelligence platform, cut manual data entry by 80% across a $17B CRE portfolio. (link)

What regulators expect banks to prove before trusting an AI vendor: AI vendor selection now requires regulator-grade scrutiny, not traditional TPRM checklists. With nearly 50% of financial institutions piloting or deploying generative AI and 8-in-10 bankers worried about falling behind, regulators are focused on explainability, actionability, bias testing, and clear accountability, all of which fall on the institution. (link)

How agentic AI is separating growing Credit Unions from shrinking ones: While total CU assets rose $86B last year, membership growth is stalling, as the average member age climbs into the early 50s and younger consumers expect fintech-grade digital experiences. 75% of Credit Unions still run on legacy LOSs. Leaders are embedding agentic AI directly into onboarding, lending, and servicing to scale efficiently, retain institutional knowledge, and adapt faster as member needs shift. (link)

How much work AI can already do is higher than most realize: A new study from MIT finds AI can already perform tasks equivalent to 11.7% of total U.S. workforce activity (about $1.2T in wages), even though only 2.2% is currently visible in real-world deployment. (link)

How CFOs are using AI to challenge assumptions before decisions are made: A new AI “decision cockpit” reframes how finance teams use models by pushing back on assumptions while decisions are being formed. Instead of entering static inputs, CFOs can interact with AI that asks about timing, capital allocation, and risk trade-offs in plain language to surface flawed assumptions early. (link)

The biggest risk with GenAI is inaction: An analysis of 765 enterprise GenAI case studies found only 21% measured financial impact, even as model capabilities surge and costs collapse by orders of magnitude. Waiting creates asymmetric risk: teams that don’t act now may preserve cash short term, but face costly catch-up, talent gaps, and lost momentum if AI becomes a true differentiator. (link)

How AI agents are transforming wealth management workflows end to end: AI agents are moving wealth management beyond surface-level personalization by automating portfolio monitoring, client engagement, onboarding, and compliance reporting in real time. By handling data-heavy, repetitive tasks, these systems free advisors to focus on strategy and relationships while enabling firms to deliver more timely, personalized advice without adding headcount. (link)

Credit Unions winning trust in 2026 are pairing modernized branches with member-first AI: New research shows that 55% of consumers say more physical locations signal a more trustworthy financial institution. At the same time, AI adoption is paying off when tied to clear member value. (link)

How a product mindset turns digital banking into a growth channel: Credit Unions must stop treating digital banking as an IT project and start managing it as a continuously evolving product. By using behavior data, segmentation, and in-app guidance, institutions are increasing adoption, doubling CRM engagement, reducing support costs, and even preventing over $1.2 million in fraud. (link)

How AI is reducing false positives and speeding AML investigations: As transaction volumes rise, legacy AML systems are overwhelming compliance teams. Research from Wipro estimates 90-95% of traditional AML alerts are false positives. AI-driven monitoring and perpetual KYC are helping institutions surface real risk faster and investigate complex laundering patterns with fewer manual reviews. (link)

Funding Spotlight

Where the money is flowing for innovation…

Torq raises $140M Series D at $1.2B valuation: Led by Merlin Ventures, the round will help Torq expand its agentic AI platform that automates SOC alert triage, investigation, and response as cyber threats outpace human teams. (link)

Cyera raises $400M Series F at $9B valuation: Led by Blackstone, the round will help Cyera expand AI-native data security and governance across cloud, on-prem, and hybrid environments. The funding reflects rising enterprise demand for platforms that secure sensitive data while enabling large-scale AI adoption without increasing regulatory or trust risk. (link)

Blackbird.AI secures $28M to counter AI disinformation: The funding brings Blackbird.AI’s total capital to $58M as enterprises and governments respond to deepfakes, narrative attacks, and synthetic media threats. With 118% year-over-year ARR growth and expanding Global 2000 adoption, narrative intelligence is emerging as a new security layer focused on protecting trust, reputation, and decision integrity. (link)

OpenAI and SoftBank invest $1B in SB Energy to secure AI infrastructure: OpenAI and SoftBank Group are each committing $500 million as part of a deal that includes a 1.2 GW data center lease and a new flagship AI campus built and operated by SB Energy. (link)

Keeping up with Tech

The latest in fintech and tools…

Claude Desktop is becoming a hands-off work executor with Cowork: Cowork brings agentic workflows into Claude Desktop so users can hand off multi-step work like research, document creation, and file organization. It can access local files and run long autonomous tasks. (link)

Revolut launches AI-driven call verification to fight impersonation scams: Revolut’s new in-app call verification detects when a user is on a phone call and confirms whether the caller is a real Revolut agent or a scammer. The feature targets AI voice deepfakes, which only about 25% of people can spot. (link)

Plumery launches AI Fabric to help banks move AI from pilots to production:. AI Fabric uses an event-driven data mesh to connect AI models to live banking data with governance and auditability. The goal is to move AI from pilots to production while enabling real-time decisions inside digital journeys. (link)

Google’s Veo 3.1 makes AI video generation more production-ready: Google’s Veo 3.1 improves character and object consistency, supports vertical (9:16) video, and adds 1080p/4K upscaling. SynthID watermarks and in-app verification add traceability as AI video moves toward mainstream use. (link)

Fiserv and Mastercard expand partnership to support agentic AI: Fiserv and Mastercard integrated Mastercard’s Agent Pay Acceptance Framework into Fiserv’s acceptance stack to support agent-initiated payments. Tokenization, authentication, and fraud controls let AI-driven transactions run on existing card rails without exposing credentials. (link)

The state of generative coding in 2026: Coding tools like Copilot, Cursor, Replit, and Lovable are increasingly writing, testing, and debugging production code, speeding delivery for experienced teams. The risk shifts to governance, reliability, security, and less room for entry-level learning. (link)

Fiserv doubles down on AI with Microsoft: Fiserv is rolling out Microsoft 365 Copilot across its global workforce and expanding use of Azure-based Foundry to build, deploy, and govern AI applications at scale. (link)

Extend introduces Memory for example-based learning in document AI: Extend launched Memory, a visual retrieval system that lets document processors learn from validated layout examples instead of relying on increasingly complex prompt tuning. The update improves classification, splitting, and extraction accuracy over time, especially for visually driven edge cases that language alone can’t capture. (link)

Microsoft partners with PayPal and Stripe for Copilot AI shopping: Microsoft is rolling out Copilot Checkout, letting users complete purchases directly inside Copilot chat as discovery, checkout, and payment collapse into a single AI-driven flow. (link)

Where AI Apps are heading in 2026: As coding and automation become cheap and reliable, the constraint in AI-driven work is no longer speed of building but clarity of judgment. New AI apps are focusing on exploration, decision framing, and human-AI collaboration, positioning software as a thinking partner rather than just a faster way to execute. (link)

Allianz integrates Anthropic’s Claude to scale governed AI across insurance workflows:

Allianz is embedding Anthropic’s Claude models into its internal AI platform to support developers, automate claims processing, and document decisions for regulatory compliance. (link)

In Other News

Related news you can learn from…

Big banks hold 75% of banking AI patents as genAI rises (link)

AI inaction is now a competitive risk for banks and Credit Unions (link)

Gen Z awareness gap threatens future Credit Union growth, survey finds (link)

Danske Bank UK appoints Dr Fiona Browne as head of AI (link)

TD Bank’s head of AI to speak on scaling enterprise AI at FinAi Banking Summit (link)

Community Corner

Memes and visuals…

Thanks for reading!

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!