How to deploy AI without alienating staff | 11/26

Plus: Columbia CU redefines digital-first member service, Gemini 3 beats ChatGPT, and more!

Happy Thanksgiving! Before you fill up on turkey and gravy tomorrow, here’s this week’s hottest AI news for Credit Unions.

Today, I cover:

How big banks deploy AI agents without alienating staff

Columbia Credit Union redefines digital-first member service

Gemini 3 smashes ChatGPT in financial reasoning

Read time: 9 minutes

Top Stories

The biggest news this week…

1) How big banks deploy AI agents without alienating staff

Banks like Citi, Citizens, and TD are learning that the hardest part of rolling out agentic AI isn’t the technology itself, but the people. What triggers excitement for some means anxiety for others.

At the Reuters AI Momentum conference, TD’s Jo Jagadish described the cultural tension: employees who use AI in their personal lives now expect the same convenience at work, while others fear losing core responsibilities. Jagadish said teams must be transparent about how productivity will be redefined and how AI removes redundant tasks so humans can focus on creativity, decision-making, and member interactions. At TD, 80% of contact center agents adopted new generative and agentic tools in just the first month, supported by months of communication and training.

Citi CIO Nikhil Joshi emphasized the same point, saying, “You must take people along,” which is why Citi’s AI training program now reaches more than 175,000 employees with an adaptive curriculum that adjusts to each learner’s skill level. Citi’s 40,000 developers now rely on agents built on Cognition’s Devin software — already used for over one million code reviews, documentation generation, and deterministic tasks like middleware upgrades, all with a human in the loop.

Citizens has rolled out GitHub Copilot’s coding agent to roughly 800 developers (about half the team) and is using Fintech partners to rewrite millions of lines of legacy code for cloud migration. The bank now uses AI agents to classify and respond to incoming complaints and automate quality control, shifting from humans reviewing 5 percent of call transcripts to AI reviewing 100 percent instantly.

Across all three institutions, AI agents are helping redeploy employees into more engaging work instead of replacing them. As Daniel Jameel of Saris AI puts it, “We make you look like a rock star,” by absorbing the work employees least enjoy while preserving human control over high-impact decisions. (link)

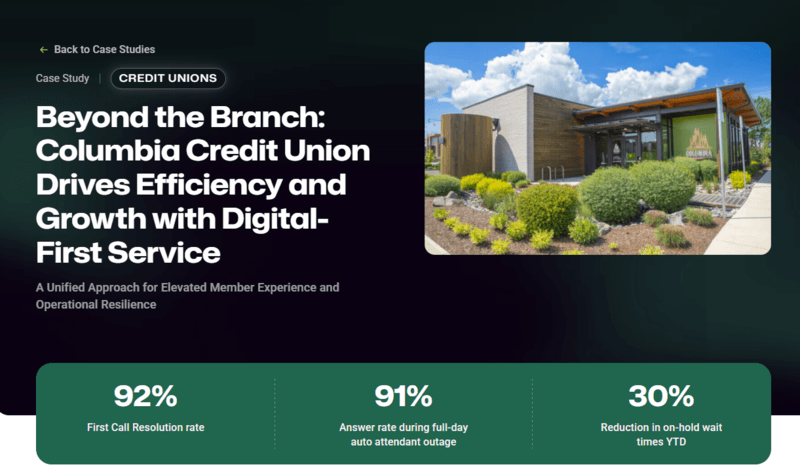

2) Columbia Credit Union redefines digital-first member service

Columbia Credit Union is showing what happens when a legacy, channel-bound contact center is rebuilt into a unified digital-first operation. After replacing its fragmented phone and chat systems with Glia Digital + Glia Voice, the Credit Union achieved a 92% first-call resolution rate, cut on-hold wait times by 30% YTD, and maintained a 91% answer rate during a full-day auto-attendant outage — routing 830 audio engagements entirely through Glia.

Digital adoption accelerated too: combined digital interactions grew 62% from 2022-2024, with another 42% annualized growth projected in 2025, driven in part by its AI assistant “River,” which already handles 51% of inquiries with a 94% understanding rate.

Behind the scenes, the unified workflow unlocked meaningful operational gains. Agent availability jumped from 65% to 73% without adding headcount, Multi-Engage enabled agents to handle more concurrent chats, and centralized reporting finally gave leadership real-time visibility across all queues. Even during the outage, Columbia CU resolved 1,073 total engagements, logged 0 member complaints, and kept members fully supported — many of whom shifted into digital channels they hadn’t used before. (link)

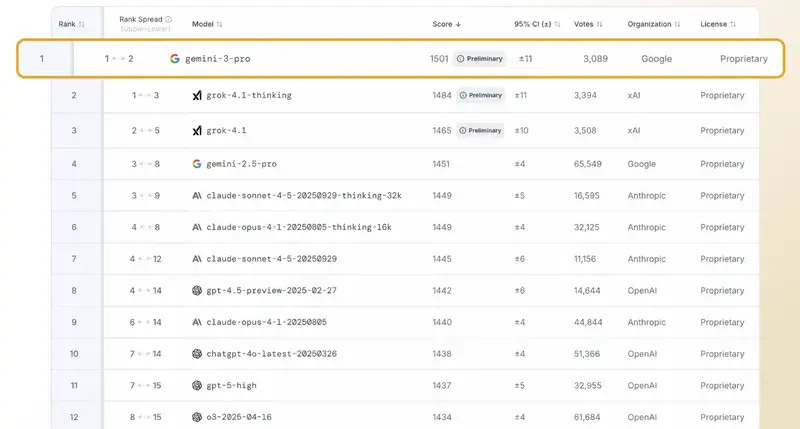

3) Gemini 3 smashes ChatGPT in financial reasoning

A new analysis of Gemini 3 suggests Google may have delivered the first AI model capable of supporting real long-horizon financial decision-making — a breakthrough with direct implications for ALM teams, CU CFOs, and finance departments.

Reviewers report that Gemini 3 provides precision “unlike anything else,” consistently pulling accurate numbers from obscure sources, reducing hallucinations, and producing verifiable reasoning across documents that never appear on the public web. The model posted record performance on RadLE, ARC-AGI-2, scientific knowledge tests at 93.8 percent, and multimodal tasks, where it can process an entire YouTube video frame-by-frame. Google deployed Gemini 3 across Search, Workspace, YouTube, Vertex AI, the Gemini app, and Antigravity — an agentic coding environment.

What matters for Credit Unions is how the model performs under long-range financial stress. On VendingBench — a full-year business simulation designed to test whether an AI can manage a dynamic economic environment without unraveling — Gemini 3 finished above 5,000 dollars, outperforming Claude Sonnet 4.5, GPT-5.1, and Gemini 2.5 Pro, all of which plateaued or lost money. Analysts say this is the clearest evidence yet that an AI system can make decisions in month one that still hold up in month twelve. Box.com’s testing showed Gemini 3 outperformed Gemini 2.5 Pro by 22 points on multi-document extraction and reasoning across PDFs, spreadsheets, screenshots, video, audio, and raw text. Finance teams can use it to pull insights from 1,000 invoices or analyze dense audit evidence with a single prompt, reducing hours of manual work.

Credit Unions can treat Gemini 3 as an early signal of what comes next in financial operations — more reliable ALM forecasting, steadier budgeting cycles, and faster cross-document analysis for audits, loan files, and regulatory packets, all of which are long-horizon tasks where earlier models struggled. (link)

Tips & Use Cases

Learn to apply AI…

How Vertice AI enables small CU teams to run big-bank targeting: The 23-person, AI-native company now supports nearly 50 Credit Unions and community banks by turning roughly 50 initial data fields into instant HELOC, deposit, indirect, and churn-risk audiences, letting even 1-person marketing teams act in minutes instead of weeks. (link)

Mac Thompson outlines an 8-step AI implementation framework for financial institutions: Institutions should anchor AI in business strategy, start with imperfect data, avoid hiring full AI labs, create a one-page definition so everyone uses the same terms, and focus on automating paper-heavy workflows instead of automating outdated processes. (link)

WOCCU releases ethical AI playbook to guide responsible Credit Union adoption: It breaks adoption into 3 phases with concrete deliverables like an Ethical AI Committee charter, AI risk-assessment report, data-governance updates, and quarterly board reviews, giving Credit Unions a practical way to deploy AI transparently while protecting members and meeting regulatory expectations. (link)

Curql’s Martin Walker says agentic AI will demand stronger CU infrastructure: Large banks like JPMorgan, Citi, and BNY are upgrading data quality, governance, and small domain models so agents can run multi-step tasks safely. This gives CUs a blueprint for automating onboarding, fraud checks, loan processing, and service without regulatory risk. (link)

AI-driven fraud now demands multilayer defenses and real-time identity intelligence: Fraud losses rose nearly 60% in 2025, US consumers lost an estimated $12.5B in 2024, and only 18% fully trust AI tools. Credit Unions must adopt behavioral analytics, biometrics, and transparent member education to stay ahead. (link)

Call-center AI is turning support hubs into scalable growth engines: Credit Unions are automating routine calls, chat interactions, and ID verification, with results like 84% call automation, 76% chat containment, 20-30 minute waits cut to under 30 seconds, and $800K in annual savings. (link)

Great ChatGPT-powered apps focus on a few sharply scoped capabilities: Teams should define small, clear operations, design structured outputs, limit inputs, and make apps discoverable so users see value on the first turn instead of navigating a full product clone. (link)

Evals turn vague AI goals into predictable, measurable performance: Create golden examples, error taxonomies, and LLM-plus-human grading loops to cut high-severity mistakes, monitor real outputs, and iteratively improve reliability in real workflows. (link)

How behavioral science boosts the ROI of AI investments: Most AI failures stem from human behavior, not technology. Studies show 95% of initiatives fall short and only 26% show ROI. Leaders must design tools around real biases, build trust, and manage adoption as a behavioral change. (link)

5R framework turns AI from pilots into real business impact: Clear roles, responsibilities, rituals, resources, and results helped one company cut risk costs by 8%, scale AI customer interactions from under 3% to nearly 60% in 18 months, and fulfill 100+ analytics requests per quarter. (link)

How agentic AI will reshape risk decisioning: Agentic systems wrap LLMs with tools, memory, and planning so they clean data, communicate with applicants, and orchestrate fraud, compliance, and credit workflows. Credit Unions can start by piloting agents for document parsing, exception handling, and underwriting, with deterministic rules and human reviewers as guardrails as they scale. (link)

How AI and human-centered Fintechs help serve small businesses better: Fintechs like Hello Alice and Bluevine show how AI can speed access to capital, simplify daily operations, and build trust for the microbusinesses that make up half of US GDP. (link)

How CFOs can write better prompts with ChatGPT 5.1: ChatGPT 5.1 now reads financial statements, runs variance and scenario analysis, and drafts board-ready narratives with far more consistent reasoning. Finance leaders who master prompt patterns and use prompt copilots can turn it into a true second brain for FP&A and reporting. (link)

AI-to-human handoffs are breaking member experience: As Credit Unions scale AI, most failures now happen when bots hand members to humans, creating dropped calls, confusion, and inconsistent service across channels. CUs must fix handoff design, retrain frontline staff, and align tech and operations to deliver smoother experiences.(link)

How Credit Unions can stop feeding competitors borrower-intent data: Lead-gen sites like LendingTree sell the same borrower lead for $20-$500 because they capture intent that CUs miss. CUs can counter by using AI-powered calculators that assess qualification, explain results, and log demand. (link)

Wells Fargo elevates AI to the executive suite: Wells Fargo named Saul Van Beurden as its companywide AI leader after rolling out AI tools to 180,000 desktops and training 90,000 employees. The new role gives him full focus to drive bankwide transformation, from ops automation to frontline productivity. (link)

How younger shoppers use AI to surface deals: Over 40% of consumers now use AI to shop, including 61% of Gen Z and 57% of millennials, and roughly half say they’d even let AI buy all their gifts to avoid stress. (link)

Banks are splitting on agentic AI adoption based on size: New survey data shows 64% of large banks are testing or deploying agentic AI, compared with just 38% of smaller institutions. Nearly all banks already using it report strong results, with 94% satisfied and only 2% saying it has no value. (link)

How lenders use AI to cut costs and boost approvals: AI now automates unstructured loan data, reduces cost-per-loan, and scales ops without new headcount. Lenders using AI for instant underwriting and ID verification see faster approvals, higher conversions, and more resilient performance in both boom and downturn markets. (link)

Wells Fargo CEO bluntly claims AI will shrink bank headcount: Wells has already cut staff by nearly 24% over 6 years, and Charlie Scharf says AI will drive further reductions as developer output rises 30-40% and repetitive call-center and credit-memo work shifts to agents. His message to leaders: redesign workflows now, retrain staff early, and avoid hiring for jobs AI will soon replace. (link)

Funding Spotlight

Where the money is flowing for innovation…

Model ML raises $75M Series A to automate deal team workflows: The startup’s AI agents pull, verify, and format data into client-ready Word, PowerPoint, and Excel files. The platform already outperforms McKinsey/Bain consultants and completes verification tasks in under three minutes. (link)

Nudge Security raises $22.5M Series A to secure the Workforce Edge: The company’s platform discovers SaaS and AI tools, maps integrations, and governs human and non-human identities. Nudge Security has grown ARR 3x, adding nearly 200 customers since 2022. (link)

Chargeflow launches AI suite after $35M Series A: Chargeflow is expanding its end-to-end chargeback automation platform as global disputes surge toward 324 million annually by 2028. Its AI achieves up to 80% success rates and 4× higher win rates than manual processes. (link)

Modern Life raises $20M Series A to modernize AI-powered life insurance: The platform gives advisors instant quotes, data-driven underwriting, and Express Decision approvals up to 4x faster while reducing costs by up to 20%. It now integrates over 30 carriers and replaces more than 10 legacy tools with one end-to-end workflow. (link)

AI-native procurement startup Coverbase raises $20M Series A: The startup reports a 90-92% reduction in procurement workloads, saving an estimated $180M in person-hours across 40+ customers. It now plans to expand into healthcare and pharma while adding spend analysis, contract intelligence, and invoicing. (link)

Blackstone invests $50M in Norm AI to scale legal-automation platform: Norm AI is expanding its AI agents for compliance and legal review and launching Norm Law, an AI-native law firm built for financial institutions. The company now serves clients managing over $30T in assets and has trained more than 35 lawyers as “legal engineers.” (link)

Pibit AI raises $7M to automate underwriting with vertical AI: The company’s CURE platform consolidates document intake, data processing, research, and risk scoring into one workflow, cutting underwriting time for US insurers. (link)

Numerai raises $30M at a $500M valuation to scale its AI-powered hedge fund: The firm’s crowdsourced Meta Model delivered a 25.45% net return in 2024 as AUM jumped from $60M to $550M in three years. New capital will expand investment capacity and support growth toward $1B+ in managed assets. (link)

Kaaj raises $3.8M seed to automate SMB credit analysis: The agentic AI platform turns full loan packages into decision-ready analysis in under three minutes, helping lenders make sub-$1M loans profitable and reduce manual underwriting work. (link)

Tidalwave raises $22M Series A to automate mortgage underwriting: The startup uses agentic AI and direct integrations with Fannie Mae, Freddie Mac, Plaid, Argyle, and Truv to cut processing times and reduce errors across the mortgage lifecycle. It aims to process 200K+ loans a year as lenders replace manual workflows. (link)

Maxima raises $41M Seed + Series A to automate month-end accounting: The startup’s AI agents prep reconciliations, journal entries, and close workflows so teams get 80% faster closes, 95% task automation, and fully auditable outputs. It targets one of the most error-prone, overworked functions in finance. (link)

Pay.com.au raises AUD$53M to expand payments and rewards platform: Pay.com.au will invest in its business rewards system and accelerate its US launch after reaching AUD$246M in annualised gross revenue and doubling its valuation to roughly AUD$633M. (link)

Keeping up with Tech

The latest in fintech and tools…

AI platform Gnomi now analyzes earnings calls. Gnomi’s new Finance Mode uses multilingual agentic AI to listen to live calls, score sentiment, and produce instant transcripts with global market context across 50+ regions. (link)

Worldpay rolls out Model Context Protocol for agentic payments: The new open, GitHub-hosted standard lets developers build AI agents that trigger autonomous payments on Worldpay’s global rails, enabling simpler integrations across 52B+ transactions and 135+ currencies. (link)

Backbase adds Unblu’s conversational tools to its banking platform: The partnership brings live chat, video, voice, co-browsing, and AI chatbots directly into Backbase’s unified employee workbench, giving staff full customer context and smoother digital-to-human handoffs across onboarding, wealth, branch, and support journeys. (link)

Dost launches AI invoice-processing and finance automation in the UK: The platform automates procure-to-pay and order-to-cash workflows with 80% lower admin costs, 95%+ accuracy, and 2.5x productivity while outperforming traditional OCR on complex invoices and ERP integrations. (link)

ID-Pal upgrades ID-detection engine to fight deepfakes: The new system flags AI-generated documents, synthetic IDs, portrait swaps, and printed forgeries, blocking four major presentation-attack types while reducing false positives. It also speeds up compliant onboarding by spotting manipulation earlier in the verification flow. (link)

Mastercard brings agent pay to the UAE: Mastercard completed its first Agent Pay transaction outside the US, piloting AI-powered shopping and payments with Majid Al Futtaim and fintech Dataiera so cardholders can use AI agents to search, discover, and transact as part of the UAE’s push to lead in AI-driven commerce. (link)

Mastercard completed its first Agent Pay transaction outside the US: The pilot in the UAE let consumers use AI agents to search, compare, and complete purchases autonomously, showing how Agent Pay could enable fully AI-driven shopping experiences. (link)

Basware rolls out agentic AI to fix error-prone invoices: Two in five invoices arrive with issues or no PO, creating a $549B blind spot. To tackle this issue, Basware’s new InvoiceAI suite uses five agents to read, code, route, and validate both PO and non-PO invoices while saving AP staff 200+ hours a year. (link)

Tech Mahindra ships AI tools for sustainability-linked lending: The new i.GreenFinance platform automates ESG scoring, loan eligibility checks, and audit-ready sustainability reporting by standardizing messy ESG data and verifying milestone-based disbursements across 15+ industries. (link)

OpenAI releases its most advanced agentic coding model: GPT-5.1-Codex-Max can handle million-token contexts, generate and review production code, and run multi-step engineering workflows with built-in defenses like sandboxed execution and prompt-injection protection. (link)

Introducing Claude Opus 4.5: Anthropic’s newest model, Claude Opus 4.5, pushes state-of-the-art performance in coding, agentic workflows, long-context reasoning, and prompt-injection resistance—while running faster and using far fewer tokens across apps, API, Excel, Chrome, and desktop. (link)

Gemini 3 capabilities you need to know: Google’s latest drop adds sharper reasoning, new creative tools like Nano Banana Pro and Veo 3.1, and an experimental Gemini Agent for scheduling and travel tasks. It also upgrades voice controls and language switching. (link)

OpenAI introduces shopping research inside ChatGPT: ChatGPT now acts as a personal buying assistant, asking clarifying questions and pulling from trusted sources to compare products and generate tailored buyer’s guides across categories like electronics, appliances, home, and beauty. (link)

In Other News

Related news you can learn from…

Fed warns AI-driven trading models could learn collusive behaviors (link)

UK commits billions to expand national AI capacity (link)

OpenAI expands independent third-party testing for frontier model safety (link)

OpenAI teams with Foxconn to build next-generation US AI infrastructure (link)

OpenAI launches nationwide AI Jam to help 1,000 small businesses build AI tools (link)

Community Corner

Memes and visuals…

Thanks for reading!

Until next week,

— Credit Union AI Guy

Enjoying this newsletter? Forward it to a colleague who might appreciate practical AI insights.

Have a question or want to share your own AI experiment? Reply to this email or connect with us on LinkedIn. We’re building a community of curious Credit Union professionals. Come join the conversation!